How to Manage Small Business Finances

Are you a small business owner looking for ways to give your venture a strong start and ongoing success?

If yes, effective financial management can significantly impact your business’s performance. It can help you cover expenses, invest in growth opportunities, and weather economic challenges that could otherwise devastate your business.

I know you are passionate about serving your customers and providing high-quality products, but with proper financial organization, even the most promising ventures can stay afloat. That’s why small businesses must take a proactive approach to managing their finances.

Trust me; it will enable you to make sound financial decisions, allocate your resources effectively, and ultimately achieve your goals. So, what are you waiting for?

Start with better expense tracking, improving cash flow, and hiring a competent accountant. After all, good financial housekeeping can help your business thrive and succeed in its respective markets.

Why Should You Stay On Top of Your Business Finances?

Do you know what it takes to keep a small business running smoothly? Finances! Yes, managing your business finances is crucial for your success and growth.

From keeping track of your cash flow and revenue to understanding financial statements and controlling expenses, there’s much to consider. And let’s remember the importance of separating your business and personal finances to avoid any confusion.

The good news is that you can turn your finances into a powerful tool for success with the right knowledge. By staying on top of your business’s finances, you can make informed decisions to help you reach your goals and take your business to new heights.

So, don’t let your finances be a source of stress or uncertainty. Instead, learn how to manage them effectively and watch your business thrive!

What are the Best Ways to Manage Your Finances?

Here are a few practical financial management strategies to help you keep your house in order and strengthen your small business’s growth potential. So, let’s dive in!

1) Set Clear Financial Goals for Each Month, Quarter, and Year

Establishing financial goals for a specific period and making sure these objectives are clear and achievable is essential. These goals may include revenue targets, desired profit margins, plans for expansion, or strategies for reducing debt.

By setting specific and measurable goals, you can give your small business direction and focus on your financial planning efforts. With these targets in mind, you can allocate resources effectively, track progress, and make necessary adjustments.

Remember that having a roadmap is essential for successful financial management. Without clear goals, it is easy to get lost in the day-to-day operations and lose sight of long-term financial objectives.

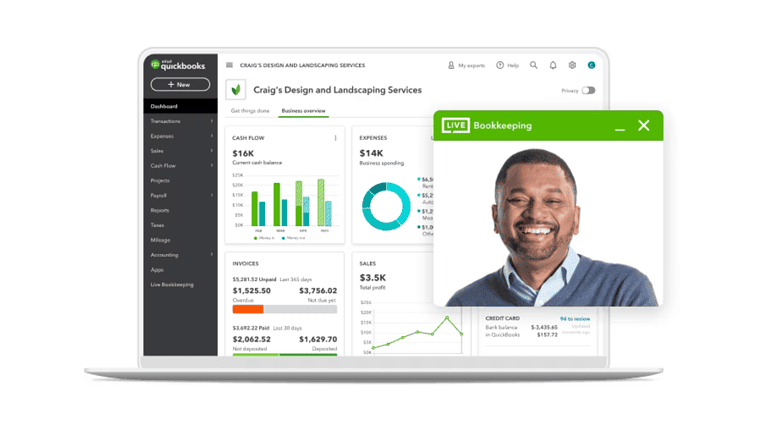

2) Choose the Right Accounting Software

Investing in the right accounting software can help streamline your business’s financial management processes. However, you should make sure to choose software solutions specifically designed for small businesses like yours.

Look for features like invoicing, inventory tracking, financial reporting, and integration with other business tools. These features can be part of a dedicated accounting solution or a module on an all-in-one enterprise resource planning (ERP) solution.

Further, excellent accounting software can show your business financials in several reports:

- Cash Flow Statement: This report shows how much money is coming in and going out of your business over a specific period.

- Balance Sheet: This statement outlines your business’s assets, liabilities, and equity at a particular point in time.

- Income Statement: Also called the Profit and Loss (P&L) statement, this report summarizes your revenues, expenses, and profits or losses over a certain period.

3) Set Clear Financial Goals for Each Month, Quarter, and Year

As a small business owner, you have to manage multiple responsibilities. Financial management can be complex and time-consuming and may require professional assistance.

Hiring an accountant can be a great option as they have specialized knowledge in financial management, tax planning, and compliance. They can offer valuable insights and guidance tailored to your small business’s needs and situations.

If hiring a dedicated accountant isn’t an option, outsourcing accounting tasks to a trustworthy firm can be a good alternative. This way, you can focus on core business activities such as sales, marketing, customer service, and closing deals.

An accountant can also ensure that your business meets tax laws, filing deadlines, and reporting requirements. This will help you avoid penalties or unfavorable audits.

When hiring an accountant for your small business, look for qualifications, experience, reputation, and compatibility with your business ethos. Find a professional who understands your industry’s unique challenges and opportunities and can provide tailored financial solutions to support your business’s success.

Kiwi small business owners will be glad to know that NZ is home to accountants Dunedin-based businesses trust, and it may not be hard for you to find quality leads.

4) Create and Monitor Your Operations Budget

To ensure the smooth operation of your small business, it is essential to set a budget and review it regularly. Firstly, identify all sources of income, such as sales revenue, investments, and loans.

Next, expenses can be categorized into fixed costs, such as rent and utilities, and variable costs, such as inventory and marketing. Finally, calculate your business’s working budget for the given period, ensuring that your income surpasses your expenses.

Regularly revisiting your budget will help you stay on track and make informed decisions for your business. If you notice any significant discrepancies, adjust accordingly to prevent financial strain.

5) Find Ways to Increase Your Cash Flow and Revenue

It is essential to keep track of the amount of money that is coming into your business. Solid cash flow management ensures you have enough funds to cover your operational expenses, debts, and investments.

To achieve a positive cash flow, consider increasing sales, cutting costs, or finding alternative sources of funding. This will help you take advantage of growth opportunities and be prepared for unexpected situations.

You can also explore options to increase your revenue, such as offering discounts, expanding your customer base, or introducing new products or services. Remember, there is no limit to the amount of income you can generate, so be creative and think outside the box.

6) Reduce Business-Related Expenses

Reviewing your overhead costs regularly and identifying areas for reducing business expenses is important. This will help you free up cash for other business needs.

Look closely at your current suppliers and see if you can negotiate better rates or find cheaper alternatives. Additionally, you can explore automating processes to reduce labor costs and consider using technology to streamline operations.

Another way to cut expenses is by implementing energy-efficient practices, such as using LED lights or upgrading equipment to more efficient models. You should also review your inventory management carefully to ensure you are not overstocking on items that don’t sell well.

This will help minimize storage costs and prevent goods from spoiling. Being mindful of your expenses can significantly impact your cash flow and improve your business’s financial health.

7) Build a Financial Safety Net

Creating an emergency fund to protect your business from unforeseen expenses or economic downturns is essential. You can achieve this by regularly setting aside a portion of your profits to build a financial safety net, which will help you cover unexpected costs and sustain operations during challenging times.

In addition, you can explore different insurance options that match the needs of your small business, such as property, liability, and business interruption insurance. These types of coverage will provide you with financial protection against risks such as theft, property damage, lawsuits, and sudden disruptions to your business operations.

8) Be Responsible with a Credit Card and Maintain a Good Credit Score

Maintaining a good business credit score and using business credit cards responsibly is essential.

A good credit score is crucial for securing loans, leases, and other forms of financing for your business. Therefore, keeping your personal expenses separate and using a business credit card responsibly by ensuring timely payments and avoiding maxing out the credit limit is essential.

Moreover, keeping a close watch on your credit score and taking measures to elevate it if required is essential. This can include paying off outstanding debts, disputing errors on your credit report, and keeping track of your credit utilization ratio.

A good credit score reflects positively on your business, indicating that you are financially responsible. It can attract potential investors or partners more willing to work with a business with a solid financial track record.

9) Seek Out Alternative Funding or Get a Small Business Loan

Securing the necessary funds to grow and expand your company can be a challenge for a small business owner. However, alternative funding options, like business loans, are available.

For example, you could try crowdfunding, which involves reaching out to many people via the Internet and asking for small donations to help fund your business. Another option is to explore grants available for small businesses in your industry or region.

Alternatively, consider applying for a small business loan if you need more capital. By carefully researching and weighing your options, you can find the funding solution that works best for your business and helps you achieve your goals.

10) Actively Monitor the Business’s Financial Performance

Keeping a close eye on your business’s financial performance and adjusting your financial management strategies as needed is essential. You and your stakeholders should agree on key performance indicators (KPIs) to measure and track progress towards your goals. These KPIs may include gross profit margin, customer acquisition cost, and return on investment.

It is essential to be aware of trends and areas for improvement. This could involve reducing expenses, optimizing pricing strategies, or taking advantage of growth opportunities. The insights you gain from monitoring your financial performance will help you make strategic decisions in the future.

Improving your business’s financial housekeeping will put you in a better position to help it grow further. Pay as much attention to financial management practices as you would to other aspects of small business, such as sales, expanding your catalog, and ensuring customer satisfaction.

Final Thoughts on Managing Small Business Finances

In conclusion, managing your small business finances is crucial for the success and growth of your company.

We have covered various aspects of financial management, from creating a budget to tracking expenses and income. By implementing these strategies and staying organized, you can ensure your business remains financially stable and prosperous.

Remember, there is always time to start taking control of your finances. Feel free to seek help from professionals such as accountants who can offer valuable advice and assistance in managing your finances effectively.

As a small business owner, it’s essential to continuously educate yourself on financial management techniques and adapt them to fit your small business’s needs. So stay informed, stay organized, and don’t be afraid to make changes when necessary.

Your dedication to managing your small business finances will ultimately lead to long-term success and growth for your company. Take action now and see its positive impact on your bottom line. Trust us, your future self will thank you!