How To Invoice Customers: Tips for Small Businesses

Invoicing is a core process for any business. Yet, it’s astonishingly common for this critical task to be mishandled, resulting in missed or delayed payments.

Even more surprising is that many businesses still invoice clients manually using individual emails or paper invoices despite the availability of more efficient digital solutions. This outdated approach leads to longer processing times and also incurs higher costs per invoice.

If businesses don’t fix this aspect of their operations soon, they risk not getting paid immediately, dealing with cash flow challenges, and straining client relationships.

Improving client management through efficient invoicing can alleviate some of these challenges by establishing clear payment terms to facilitate quick payment from clients and distinguishing client management software from basic invoicing and accounting tools.

What is the Invoicing Process?

Invoicing is the cornerstone of any business transaction. It’s the formal document a seller sends to a buyer detailing the products or services provided, their respective costs, payment terms, and other pertinent information.

The invoicing process is how businesses generate, send, track, and manage these vital financial documents. The invoicing process involves:

- Generating the Invoice: Compiling details like item descriptions, quantities, prices, taxes, and importantly, assigning an invoice number for efficient tracking and future referencing.

- Adding Payment Terms: Stating when payment is due, any discounts, or penalties.

- Sending the Invoice: Delivering it promptly via email, mail, or electronic platforms.

- Tracking and Following Up: Monitoring payments, sending reminders for overdue invoices, and applying late fees if necessary.

- Recording Payments: Accurately noting received payments in financial records.

- Archiving Invoices: Systematically storing invoices for future reference or audits.

- Analyzing Invoice Data: Utilizing a robust invoicing system to gain insights into financial health, customer payment trends, and areas for improvement.

By following this process, businesses can ensure timely payments, maintain cash flow, and nurture positive customer relationships.

Why You Need to Know How to Send an Invoice

Sending invoices efficiently is fundamental for the health and success of your business. Firstly, it ensures prompt payment, which is vital for maintaining a healthy cash flow. Timely invoicing communicates clear payment terms to your clients, encouraging them to fulfill their obligations promptly and reducing the risk of delayed or missed payments.

Moreover, professional invoices not only facilitate payment but also bolster your business’s credibility and reputation. Well-crafted invoices demonstrate professionalism and attention to detail, instilling confidence in your clients and fostering long-term relationships. They serve as legal documents that outline the terms of the transaction, providing protection in case of disputes and ensuring compliance with regulatory requirements.

In addition to financial benefits, efficient invoicing enhances operational efficiency and productivity. Streamlining invoicing processes saves time and resources, allowing you to focus on core business activities and strategic growth initiatives. Automated invoicing systems further improve efficiency by reducing manual tasks and minimizing the risk of errors, contributing to overall business agility and competitiveness.

In summary, mastering the art of sending invoices is essential for sustaining and growing your business. It facilitates timely payments and financial stability, enhances professionalism, fosters trust with clients, and ensures compliance with legal and regulatory standards.

By prioritizing efficient invoicing practices, you can streamline operations, optimize cash flow, and position your business for long-term success. Mastering invoicing is particularly crucial for a freelance business to maintain cash flow and client relationships, allowing freelancers to focus on their talents and serve their clients effectively.

Best Practices for Invoicing Clients

To help your own small business bypass these potential pitfalls, here’s a concise list of invoicing best practices that will allow you to collect payments promptly and efficiently:

#1) Consider Utilizing Digital Invoices

According to the independent market research platform Gitnux, 57 percent of companies still rely on manual processes when inputting information on their invoices. Unfortunately, doing this manually may result in costly mistakes and missed opportunities for revenue improvement.

For starters, small businesses should explore automated invoicing systems that can minimize errors when inputting information such as the total due amount, due date, and reference numbers. Further, you can build an invoice template to easily send invoices to your customers to get paid faster.

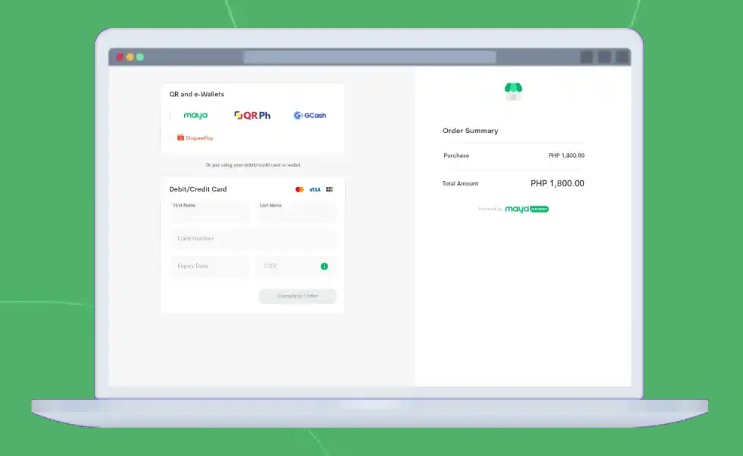

In terms of ease of payment, a digital invoice payment system like that of the Philippines’ Maya Business can present the payer with a variety of cashless payment options, such as credit and debit cards, digital e-wallets, and QR code payments. With links or QR codes to payment options immediately available, you can reduce friction in the payment process and prevent payment delays. What’s more, you can send your digital invoices through email and a variety of messaging apps, whichever your client or customer prefers.

With the right invoicing software, you need only a few clicks to effortlessly create and send online invoices that can be settled within seconds. As a bonus, you’ll also be reducing your business’s environmental footprint. Square Invoices is another user-friendly digital invoicing solution that can help small businesses manage online payments more efficiently.

#2) Streamline Your Invoicing

Use invoice templates and keep your invoices clear, concise, and easy to comprehend. Avoid overwhelming your customers or clients with unnecessary details, and instead, focus on presenting essential information with complete clarity and legibility.

For example, if there’s a discount for early payment, include it and make it easy to identify in the invoice. Also, avoid including hidden fees that may surprise your client or customer.

In addition, utilize consecutively number invoices for easy reference, and consider categorizing items to provide a more transparent breakdown of costs. A streamlined invoice will communicate professionalism and integrity on your part and also minimize the risk of confusion or disputes.

#3) Double Check the Invoice Details

Accuracy should be your top priority when it comes to invoicing. According to industry surveys, most delayed payments are due to invoicing errors. Before sending out any invoice, you and your staff should meticulously review all details to ensure that there are no errors or omissions.

From product or service descriptions and quantities to prices and tax calculations, every aspect of the invoice should be double-checked. If your business sends multiple invoices and you still rely on manual entries, errors are bound to occur.

Again, be diligent in checking your invoices and consider using digital invoicing tools to avoid payment delays and maintain your clients’ trust.

#4) Incorporate Your Brand in Your Invoice

You can also use these simple documents to extend your brand identity and remind your customers of your brand’s core values. Start by incorporating your company logo, colors, and fonts into your invoices to reinforce brand recognition and professionalism.

Use your logo for the invoice header, along with your contact information and address. Alternatively, you can use your logo and tagline for a watermark design. Choose a reader-friendly version of your brand fonts to add a personal touch to your invoice document.

Whether using manual or automated invoicing, you can maintain your brand’s cohesive visual identity by branding your invoice. Doing so will make you more memorable to your customers and clients and help them associate your brand with values like honesty, integrity, and excellence.

#5) Include Your Due Date and Billing Schedule

It cannot be overstated: clear communication is key regarding payment terms. Ensure your invoices prominently display the due date and outline the billing schedule. In some cases, companies may highlight the billing due date and total amount due in a larger or bold font to ensure the customer understands the most pertinent information in the invoice.

What’s important is to clearly state the payment expectations upfront to avoid confusion. This is also helpful in setting a precedent for timely payments. Lastly, consider offering incentives for early payment to motivate customers or clients to make prompt settlements.

#6) Follow Up On Invoices

Don’t let overdue invoices linger in limbo. Implement a proactive approach to invoice follow-up to ensure prompt payments from your customers and clients.

To do this, you can send polite reminders for outstanding invoices and maintain open communication channels to address any concerns, especially late payments. Remember that staying on top of your invoicing is important, as this demonstrates professionalism and upholds your end of the business relationship.

#7) Send a Thank You Note After Payment Has Been Received

Gratitude goes a long way in business. Once payment has been received, take a moment to express your appreciation to your clients and customers.

You don’t have to include grand gestures in this final step. All it takes is sending a simple email or direct message thanking them for their payment.

In addition to reassuring payers that their payment has been acknowledged and processed, this fosters goodwill and paves the way for lasting business relationships.

Key Considerations For Successfully Invoicing Clients

Understanding the process and implications of paying invoices is crucial for the financial health of any business. Failure to pay invoices can lead to legal actions, including the involvement of debt collection agencies or attorneys.

When dealing with unpaid invoices, it’s important to consider the terms of contracts and the financial feasibility of lawsuits. Ensuring timely payment helps avoid these potential legal complications and maintains healthy business relationships.

Final Thoughts on Sending Invoices

Customer invoicing facilitates smoother cash flow and supports other business operations. Through best practices like the ones listed above, your company can improve its revenue management and, in addition, gain trust and credibility among the people it serves.

Implementing these invoicing practices ensures your business gets paid on time, enhancing financial stability and fostering long-term client relationships.