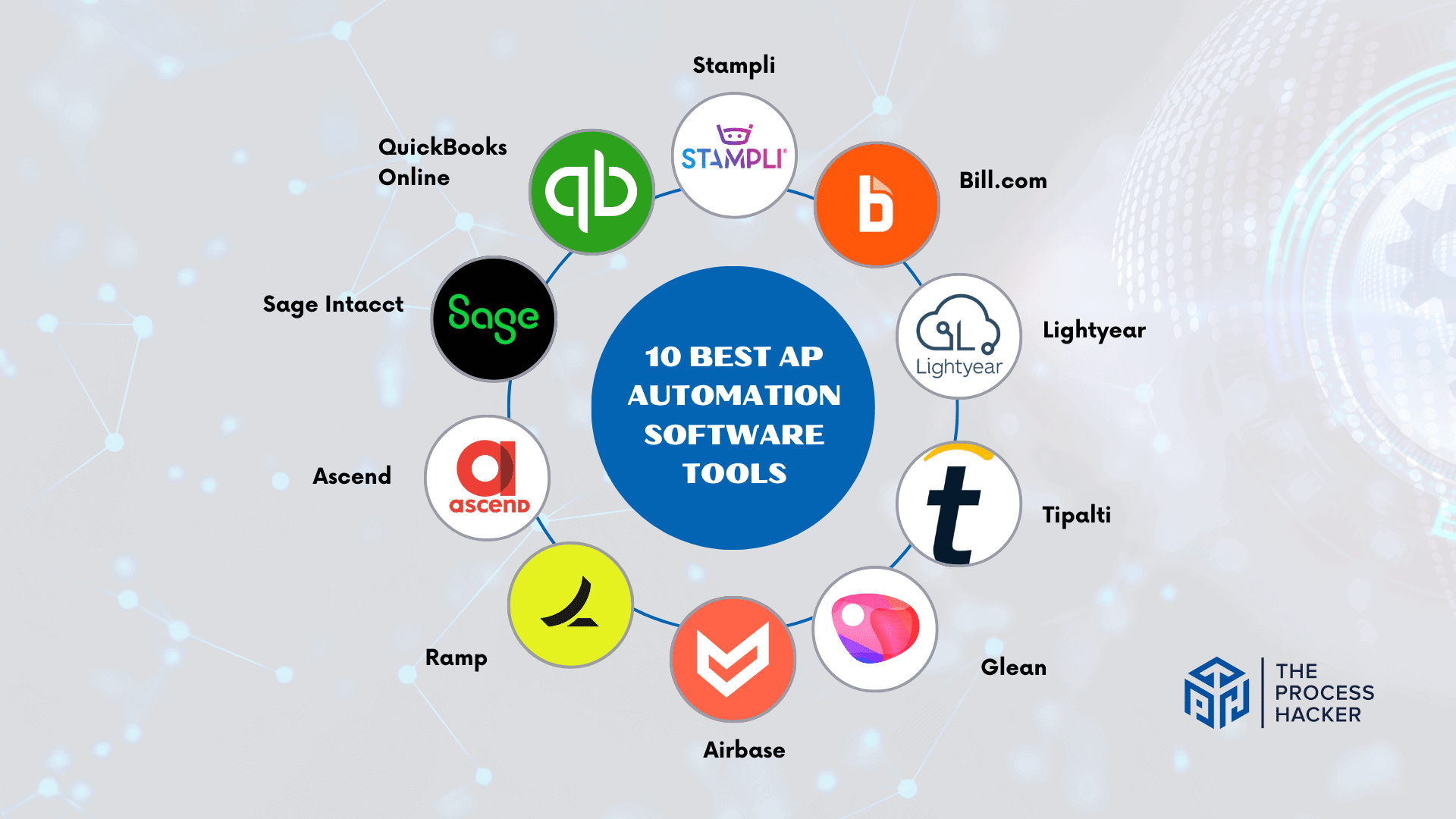

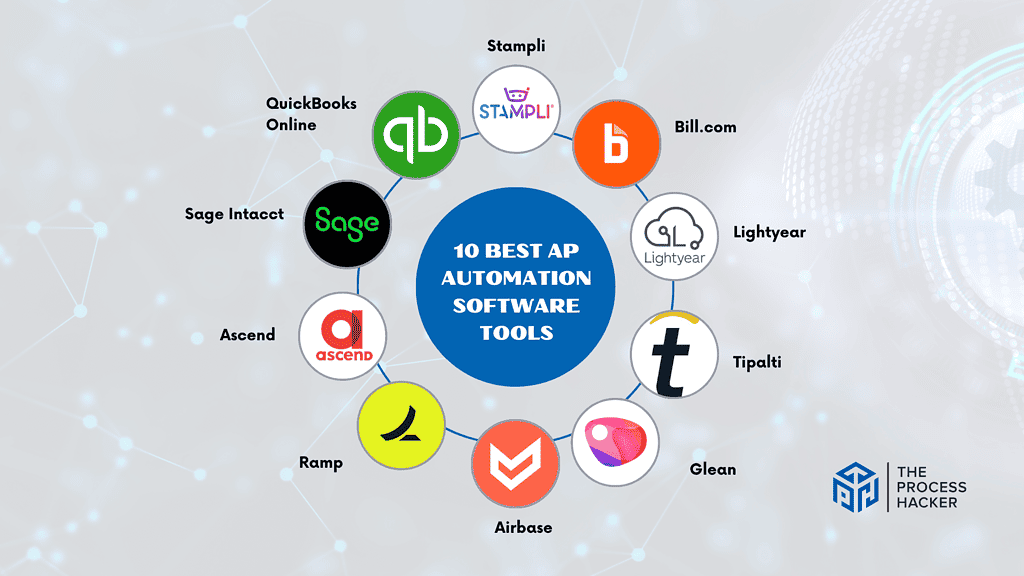

The 10 Best AP Automation Software Tools In 2024

Are you seeking for the finest accounts payable automation software to help you optimize your accounts payable operations?

Automation is a critical component of operating any organization effectively. If accounts payable (AP) takes up too much of your valuable time, you should investigate automated alternatives.

Choosing the suitable AP automation software for your business may be difficult since different apps provide various functions such as invoice processing automation, expenditure management, and payment optimization services.

If you purchase through our partner links, we get paid for the referral at no additional cost to you! For more information, visit my disclosure page.

Don’t worry—our thorough guide has all the information you need to select the finest AP automation software for your company this year!

We’ve compared the features, advantages, and price of the finest AP automation software to help you choose the right solution for your company.

Are you ready to automate your AP and not have to worry about it anymore? Continue reading!

What Are the Best AP Automation Software Tools?

Every company must have clear documentation of business processes to stay ahead and be competitive, especially in the modern workplace. Automating accounts payable (AP) in the enormous AP automation software industry is one option to boost your company’s productivity.

Some of the best AP automation software tools include the following:

- QuickBooks Online – Best All-In-One Automation Software Tool

- Stampli – Best Overall AP Automation Software Tool

- Bill.com – Best AP Automation Software Tool for Small Businesses

- Lightyear – Best AP Automation Software Tool for Large Enterprises

- Tipalti – Best AP Automation Software Tool for International Business

- Glean – Best AP Automation Software Tool with Built-in AI

- Airbase

- Ramp

- Ascend

- Sage Intacct

These software programs automate workflows and business processes, including invoice processing, vendor management, payment processing, and early payment discounts. These automation technologies make laborious activities easier, saving organizations time, reducing mistakes, and increasing profits.

Utilize one of these top AP automation software programs immediately to give yourself a competitive edge in the industry!

#1) QuickBooks Online – Best All-In-One Automation Software Tool

QuickBooks Online is a cloud-based accounting software solution designed to help businesses manage their finances. It offers features such as AP Automation, invoicing, expense tracking, real-time budgeting and forecasting tools, and payroll processing.

It also comes with comprehensive financial reporting capabilities, allowing users to generate customizable reports that can be shared easily with stakeholders.

The platform integrates with third-party applications such as point-of-sale systems, eCommerce platforms, and payment processors.

Key Features

- Automated accounts payable processes

- Comprehensive budgeting and forecasting tools

- Accessible from anywhere, anytime

- Real-time financial reporting capabilities

- Integration with third-party apps for streamlined workflow

- Automated payroll

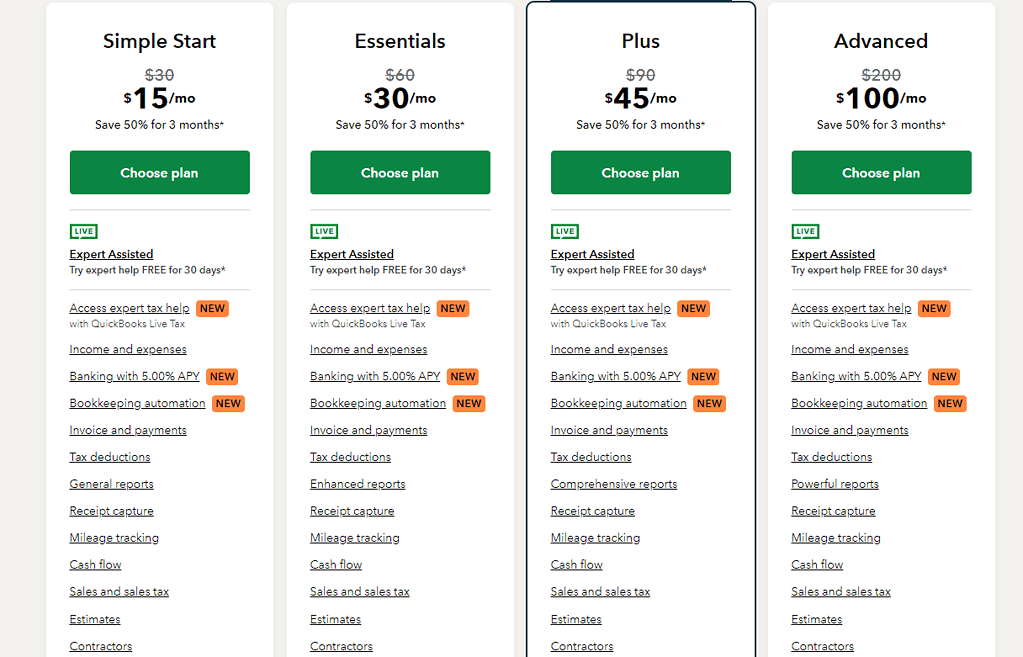

Pricing

Quickbooks has customizable pricing, with options beginning at $15 per month for the Simple Start option. Select from the Essentials, Plus, or Advanced levels to get more features to meet your company requirements.

Pros & Cons

Pros

Cons

QuickBooks is an advanced all-in-one financial application that saves companies time and money by automating numerous financial operations, including account payable automation.

#2) Stampli – Best Overall AP Automation Software Tool

Overview

Stampli is an automated invoice and payment processing technology that streamlines and automates the accounts payable workflow.

It offers features such as invoice routing, approval procedures, and reconciliation tools to assist firms in streamlining their accounts payable operations.

Stampli also offers a secure cloud-based platform that enables customers to view data from anywhere with an internet connection.

Key Benefits

- Automates the invoice routing and approval procedure.

- Secure cloud platform allows for quick data access.

- Provides reconciliation tools and analytical capabilities.

Pricing

Stampli provides transparent, usage-based pricing, guaranteeing that you only pay for what you use. For additional information, visit their website and get a quotation.

Pros & Cons

Pros

Cons

#3) Bill.com – Best AP Automation Software Tool for Small Businesses

Bill.com is a software-driven accounts payable system that helps businesses optimize their financial management operations while freeing resources for more critical duties.

It links with top accounting tools, enabling users to file and process invoices quicker, monitor real-time payments, and oversee dealings with vendors from a single dashboard.

Bill.com also provides a full set of tools, like cash flow management, limitless invoicing, and automatic fraud detection.

Key Features

- Accounts payable operations automation

- Optimized invoicing handling

- Real-time visualization of cash flow

- Financial planning and forecasting tools

- Easy to access from anywhere, at any time

- Automated fraud detection capability

- Pricing is very adjustable and straightforward

Pricing

Bill.com has tiered pricing that begins at $45 per user per month, including options for both companies (Essentials, Team, Corporate, Enterprise) and accountants (BILL AP & AR Partner, BILL Spend & Expense Partner). Extra features and services can be purchased for an additional cost.

Pros & Cons

Pros

Cons

#4) Lightyear – Best AP Automation Software Tool for Large Enterprises

Overview

Lightyear is an automated invoicing and payment processing technology that assists large corporations in streamlining their accounts payable duties.

It supports multi-level approval procedures, automatic payment reconciliation, and vendor management.

Lightyear likewise works with major accounting software, such as QuickBooks Online and Xero, making it an excellent solution for companies wishing to streamline their AP operations.

Key Benefits

- Multi-level approval workflows

- Automated reconciliation of payments

- Vendor management skills

- Integrate with major accounting software

Pricing

Lightyear has three price options: starter, business, and enterprise. Prices begin at $149 per month and might rise based on the extra credits your firm may need.

Pros & Cons

Pros

Cons

#5) Tipalti – Best AP Automation Software Tool for International Business

Overview

Tipalti is an accounts payable automation app that helps multinational corporations optimize their AP procedures.

It includes features including automated invoice processing, vendor payments, a multi-level approval procedure, and analytics tools to help organizations manage their payment operations more conveniently and effectively.

Tipalti integrates with major accounting software such as QuickBooks Online and Xero, making it a great option for organizations that already use other popular accounting tools.

Key Benefits

- Automates AP and invoice processing

- Vendor payments

- Multi-level approval process

- Analytics capabilities

- Integrates with standard accounting software

Pricing

Tipalti’s price is tailored to your specific company requirements; therefore, you must contact them for an estimate. Their price strategy expands with your organization, providing flexibility and sophisticated functionality for complicated payables processes.

Pros & Cons

Pros

Cons

#6) Glean – Best AP Automation Software Tool with Built-in AI

Glean is an AI-powered platform that enables organizations to automate their financial procedures. It automates processes including data collecting, financial forecasting, and analytics.

The platform employs natural language processing to extract insights from a variety of raw financial data sources, including as ERPs, spreadsheets, and text documents. Glean also provides predictive analytics capabilities, allowing firms to better understand how their financial strategies will function in the future.

Glean enables organizations to rapidly detect data patterns and establish plans to optimise operations and drive development. The software also includes automatic reporting, budgeting tools, and financial dashboards to help you monitor and manage business performance KPIs.

Key Features

- Automatic client segmentation and targeting

- Lead generation via different channels

- Use A/B testing to improve marketing

- Personalized content delivery

- Real-time analysis and reporting

- Powerful AI skills to improve email marketing campaign KPIs

Pricing

Glean.ai empowers seamless collaboration with unlimited users across all plans. Pricing is based on transaction volume, not headcount, ensuring cost-effective spend management for teams of any size.

Pros & Cons

Pros

Cons

#7) Airbase

Overview

Airbase is a fully integrated accounts payable and expenditure management software that automates the whole process, from invoice processing to payment.

Airbase also provides vendor payments, expenditure approvals, and automated accounting reconciliation capabilities. Airbase’s elegant user interface enables users to manage their AP procedures quickly and effectively.

It also interacts with major accounting software such as QuickBooks and Xero, making it a good solution for businesses that already use these tools.

Key Benefits

- Automates invoice processing and vendor payments

- Provides spending approval and automatic accounting reconciliation

- Integrates with standard accounting software

- The user interface is intuitive

Pricing

Airbase provides three price levels based on the number of employees: standard, premium, and enterprise. You may get a quotation for packages on their website.

Pros & Cons

Pros

Cons

#8) Ramp

Overview

Ramp is an all-in-one accounts payable automation software that optimizes every step of the AP process, from invoice management to payment.

It provides automated data input, vendor management, and conciliation solutions.

Ramp also connects with major accounting software, such as QuickBooks Online and Xero, thereby rendering it easier for companies who currently use these tools.

Key Benefits

- Automates data entry

- Vendor management capabilities

- Reconciliation tools

- Integration with popular accounting software

Pricing

Ramp offers three pricing plans: Ramp, Ramp Plus, and Enterprise. Prices start at $15 per user per month, and a customizable value assessment for the Enterprise plan.

Pros & Cons

Pros

Cons

#9) Ascend

Overview

Ascend is an account payable automation tool that improves the AP process. It helps businesses enhance their operations by providing automated invoice processing, a multi-level approval process, and vendor management tools.

Ascend also interacts with popular accounting software, like QuickBooks Online and Xero. With its robust capabilities, flexible price options, and user-friendly interface, Ascend is an excellent solution for organizations of all sizes.

Key Benefits

- Automates invoicing processing

- Multi-level approval process

- Vendor management skills

- Integrates with standard accounting software

Pricing

Ascend provides a free plan for basic payment administration and configurable premium solutions tailored to your company’s particular requirements.

Pros & Cons

Pros

Cons

#10) Sage Intacct

Sage Intacct is cloud-based financial management software designed to help businesses manage their finances. It offers a suite of powerful capabilities, including automated accounts payable solutions, cash flow tracking and forecasting tools, budgeting and reporting features, and more.

The platform also provides real-time access to data, allowing for better visibility into spending patterns and performance insights. Its customizable dashboards provide key insights to help businesses make more informed decisions, and its fraud detection capabilities offer additional peace of mind.

Key Benefits

- Automates account payable operations

- Comprehensive budgeting and forecasting tools

- Provides real-time insight into cash flow

- Accessible from anywhere, at any time

- Automated fraud detection capability

- Highly configurable and user-friendly interface

- Comprehensive set of money management features

Pricing

Sage Intacct’s price strategy is subscription-based, with charges suited to your unique needs. Prices are influenced by the amount of users, corporate entities, and modules (features) required.

Pros & Cons

Pros

Cons

What Is AP Automation Software?

Accounts Payable (AP) automation software simplifies the process of handling invoices, payments, and cash flow.

They automate data input and validation procedures, remove manual processes, decrease mistakes and delays, increase expenditure visibility, and enable speedy vendor payments.

The accounts payable solution integrates with current ERP, finance, and procurement software systems. The user-friendly design of the interface optimizes payment cycle management, invoice inspection, and payment approval. It also has built-in fraud detection tools that assist identify suspicious activities in real time.

AP automation software offers customizable reporting capabilities to help company owners better comprehend their finances. This enables them to spot anomalies quicker and provide more reliable data for decision-making.

Overall, finance automation is an excellent approach to optimize the effectiveness and precision of your accounts payable procedures, allowing you to reduce expenses and increase cash flow. It offers a basic solution that can be completely modified to meet the specific requirements of your company.

How Can AP Automation Software Benefit You?

AP automation software may help organizations save time and money by automating the accounts payable process.

It eliminates human data input, minimizes mistakes, and automates repetitive business payment processes. This may result in speedier processing times and more accurate payment cycles.

Businesses gain from enhanced insight into spending patterns, which enables them to better understand their finances without having to manually evaluate and analyze data. This may assist detect differences immediately, allowing for more informed decision-making.

AP automation software also includes fraud detection features, which provide an additional degree of protection against illicit activities. This may assist firms avoid false charges or payments that might harm their image.

Furthermore, automating the accounts payment process may help organizations boost customer satisfaction. Customers get payments more quickly and correctly because processing times are reduced and human data input is eliminated. This enhanced client experience leads to stronger connections and increased customer loyalty.

Overall, AP automation software is a simple and inexpensive account payable automation solution that may greatly benefit your company by increasing accuracy, efficiency, and financial visibility. It helps to decrease time-consuming manual operations, allowing you and your company to concentrate on what is most important: increasing earnings.

Buyers Guide: How We Conducted Our Research

We investigated and assessed several AP automation solutions to determine the best ones available. We considered a variety of variables, including simplicity of use, functionality, integrations, customer service, price structure, and more. After much thought, we gathered our results into this buyer’s guide.

We hope our study may assist you in finding the finest AP automation solution. If you have any issues or want further support, please do not hesitate to contact us. We look forward to hearing from you.

Final Thoughts on Accounts Payable Software

AP automation may help you decrease human tasks, enhance the accuracy and visibility of financial data, and raise customer satisfaction.

Automating accounts payable operations is critical for any company looking to remain competitive in today’s AP automation software market.

We hope this AP automation guide will help you find the perfect solution for your needs and budget. With the right software, you can improve the accuracy and efficiency of your AP process and save time for more important tasks.

Good luck with your search! We are confident that with our guidance, you will find the best-fit tool for your business automation needs.

Frequently Asked Questions

What is Accounts Payable Automation?

Accounts payable automation, also known as AP automation, is the process of streamlining manual accounts payable processes through software. This helps to reduce time-consuming manual tasks and improve accuracy, efficiency, and visibility into finances.

What are the benefits of AP Automation?

There are several benefits to automating accounts payable processes. These include improved accuracy and visibility, reduced time-consuming manual tasks, decreased risk of errors, streamlined payment tracking and reporting capabilities, and improved customer satisfaction.

How do I choose an AP software?

When selecting an AP automation provider, consider the features that best fit your needs. Also, look for providers with a good reputation and solid customer reviews. Finally, make sure to compare prices to ensure you get the most bang for your buck.

How can I learn more about AP automation?

For more information about AP automation and how to choose the right provider, read our buyer’s guide here. You can also do your own research and find additional resources online.

Is AP automation worth it?

Yes, AP automation is an excellent investment for businesses of any size. Automating accounts payable processes helps save time and money, reduce the risk of errors, improve financial visibility, and increase customer satisfaction.

What is a typical implementation timeline for AP automation?

Each implementation timeline will depend on the complexity of your processes and the provider you choose. Generally speaking, most implementations can be completed within two weeks.

Can AP automation help me save money?

Yes, AP automation can help businesses save time and money by reducing the need for manual processes and improving accuracy. Additionally, automating accounts payable processes can help companies reduce the risk of errors and streamline payment tracking and reporting capabilities.