The 11 Best AR Automation Software Tools In 2024

Cash flow is the lifeblood of any business, but collecting payments from customers on time and managing accounts receivable can be a real challenge.

As business owners, we’ve all been there scrambling to send out invoices, chase down late payments, and spend hours each week just keeping track of who owes what. But what if there was a better way to streamline billing and collections so you could spend more time growing your business instead of being stuck behind a desk?

If you purchase through our partner links, we get paid for the referral at no additional cost to you! For more information, visit my disclosure page.

Advances in accounts receivable automation software give entrepreneurs powerful tools to tackle their Accounts Receivable (AR) headaches head-on.

Through features like automated invoicing, online payment portals, late fee management, collection reminders, and robust reporting, these AR automation tools are helping thousands of companies accelerate cash flow, reduce DSOs, and get paid faster so they can free up valuable time and resources.

In this blog post, we’ll discuss our top picks for the leading payments management solution, helping you take control of your business finances and cash flow once and for all.

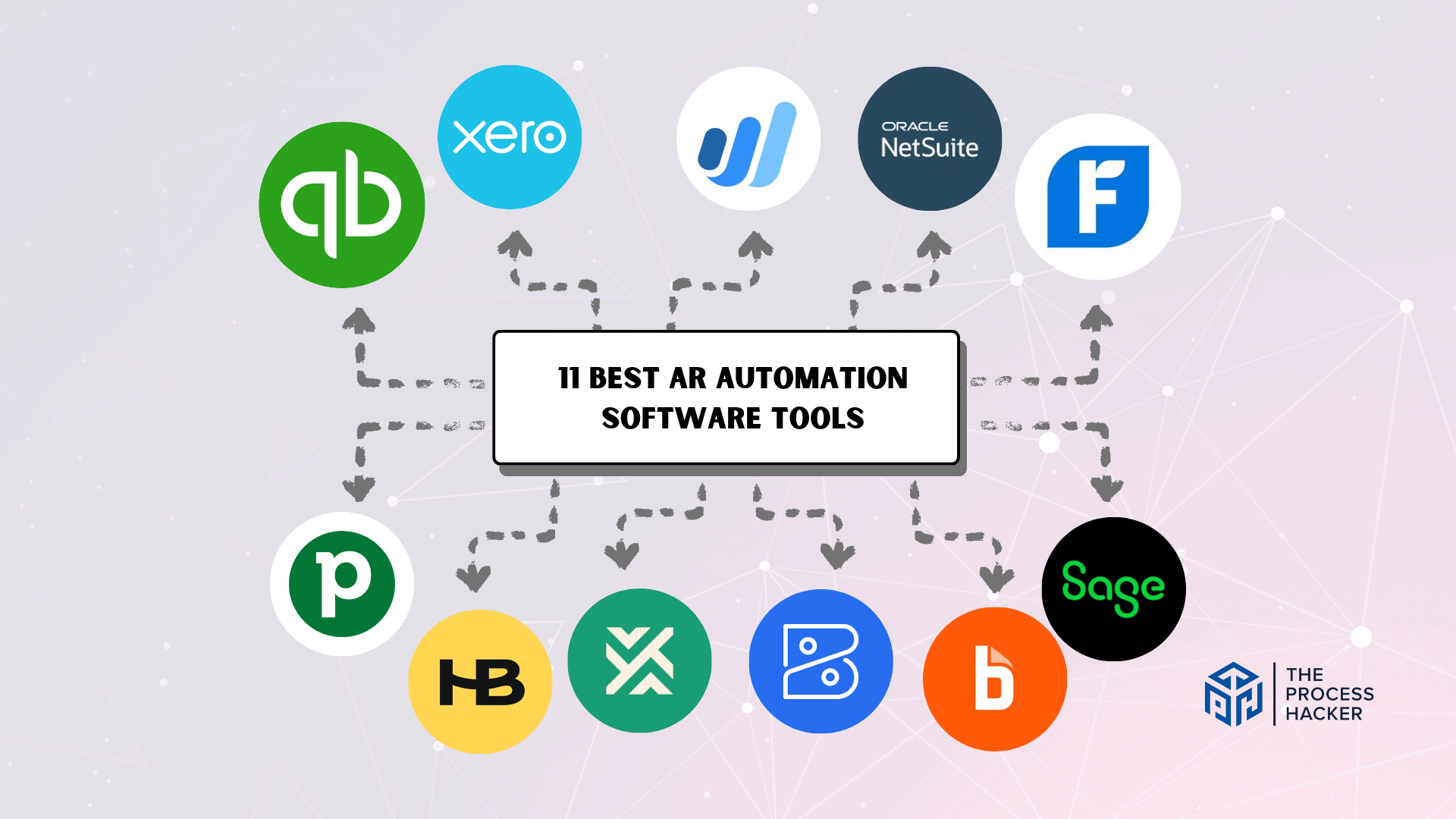

What Are the Best AR Automation Software Tools?

Whether you’re managing a small business or steering a large enterprise, this list has something tailored just for your accounting needs. Here are the leading AR automation software tools that stand out:

- Quickbooks Online – Best Overall Accounts Receivable Software

- FreshBooks – Best Runner-Up Accounts Receivable Software

- HoneyBook – Best Accounts Receivable Software for Freelancers & Solopreneurs

- Xero – Best Affordable Accounts Receivable Software

- Oracle Netsuite – Best Enterprise-Level Accounts Receivable Software

- Pipefy – Best Accounts Receivable Software for Other Business Processes

- Wave – Best Accounts Receivable Software for Small Businesses

- Zoho Books – Best Accounts Receivable Software for the Zoho Suite

- Bill – Best Accounts Receivable Software for Simplified Invoicing

- Sage50 Cloud – Best Accounts Receivable Software for Small Business Accounting Flow

- Invoiced – Best Accounts Receivable Software for B2B Invoicing Network

Dive deeper into each option to understand what makes them the best. The following sections will provide detailed insights to guide your choice effectively.

1) Quickbooks Online – Best Overall Accounts Receivable Software

Overview

QuickBooks Online is a popular and reliable choice for businesses seeking a comprehensive accounting solution with powerful AR automation capabilities. Streamline your invoicing process, offer convenient payment options for customers, and gain valuable insights into your accounts receivable metrics.

Key Benefits

- Effortlessly creates and automatically sends professional invoices

- Offers flexible payment options, including credit cards, online payments, and ACH transfers

- Sends automated reminders to nudge customers about overdue payments gently

- Provides insightful AR reporting to help you make informed financial decisions

Pricing

QuickBooks Online offers several plans, starting with the Simple Start plan at $6.25 per month. Pricing for Essentials, Plus, and Advanced plans varies based on your business needs.

Pros & Cons

Pros

Cons

QuickBooks Online is a powerful choice for businesses of all sizes seeking robust accounting and AR automation in one platform.

2) FreshBooks – Best Runner-Up Accounts Receivable Software

Overview

FreshBooks is an all-in-one small business invoicing and accounting solution that excels in accounts receivable management. It is particularly user-friendly, making it ideal for freelancers, self-employed professionals, and small to medium-sized businesses.

Key Benefits

- Easy-to-use invoicing that allows for quick payment processing

- Automated expense tracking to reduce manual data entry

- Customizable invoices to enhance brand consistency

- Robust reporting features for financial insights and decision-making

- Mobile app availability for managing finances on the go

Pricing

FreshBooks pricing starts at $19 per month on the Lite Plan, which is ideal for freelancers. Other plans include Plus for the self-employed, Premium for businesses with contractors, and a customizable plan, which caters to a wide range of business needs and sizes.

Pros & Cons

Pros

Cons

3) HoneyBook – Best Accounts Receivable Software for Freelancers & Solopreneurs

Overview

HoneyBook is one of the best all-in-one accounts receivable platforms designed to help freelancers and solopreneurs streamline client management, from proposals and contracts to invoicing and payments. Its AR automation features make getting paid easier and faster, letting you focus on your work.

Key Benefits

- Intuitive interface that simplifies the management of accounts receivable processes

- Integrated invoicing and payment solutions that facilitate quick and easy transactions

- Customizable templates that enable users to create professional invoices and contracts

- Robust reporting tools that provide insights into financial performance and cash flow

- Client management features that help maintain strong customer relationships

Pricing

Pricing starts at $19 per month for the Starter Plan. HoneyBook also offers Essentials and Premium plans with expanded features as your business scales.

Pros & Cons

Pros

Cons

4) Xero – Best Affordable Accounts Receivable Software

Overview

Xero is a comprehensive and user-friendly accounting platform for small to medium-sized businesses. Its cloud-based nature ensures that financial data is accessible anytime, anywhere, providing flexibility for users.

Key Benefits

- Simplifies the invoicing process by automating invoice creation and sending

- Offers up-to-date financial reports, enabling businesses to make informed decisions quickly

- Ensures that financial data is accessible from any device

- Allows businesses to transact in various currencies, which is essential for global operations

- Seamlessly integrates with various third-party apps and services

Pricing

Pricing for Xero’s Early Plan starts at $3.75 per month, catering to small businesses or individuals requiring basic AR functions. For businesses seeking more advanced features, Xero offers Growing and Established Plans, which include multi-currency support and expansive analytics, ensuring scalability as business needs evolve.

Pros & Cons

Pros

Cons

5) Oracle Netsuite – Best Enterprise-Level Accounts Receivable Software

Overview

Oracle NetSuite is a comprehensive Enterprise Resource Planning (ERP) platform for complex business needs. Its AR automation tools provide robust features for managing invoicing, payments, and collections within a larger business management system.

Key Benefits

- Adapts to the unique requirements of large enterprises

- Provides deep insights into AR performance

- Handles multi-currency transactions and international operations

- Offers seamless workflow across finance, inventory management, and more

- Includes payment reconciliations, collections management, and more

Pricing

Oracle NetSuite’s pricing is customized and requires contacting their sales team for a quote. Expect a base price of approximately $99 per user per month, plus a $999 monthly licensing fee, though your specific costs could be higher or lower depending on your company’s needs.

Pros & Cons

Pros

Cons

6) Pipefy – Best Accounts Receivable Software for Other Business Processes

Overview

Pipefy Finance is an intuitive, flexible process management tool that extends its capabilities to accounts receivable. It enables businesses to streamline their financial operations alongside other core business processes.

Pipefy’s user-centric design and customization options make it adaptable for various industries, enhancing workflow automation and data management.

Key Benefits

- Streamlined process management integrates AR with other business operations

- Customizable workflows to align with specific business needs

- Advanced reporting and analytics for better financial oversight

- Automation of repetitive tasks to increase efficiency

- User-friendly interface that requires minimal training

Pricing

Pipefy’s Business Plan, designed for Small—to Medium-Sized Businesses, begins at $24 per user per month. For larger organizations requiring advanced features like enterprise-level security and control, Pipefy offers Enterprise and Unlimited Plans.

Pros & Cons

Pros

Cons

7) Wave – Best Accounts Receivable Software for Small Businesses

Overview

Wave is one of the ideal and popular accounts receivable software for small businesses, offering a comprehensive, user-friendly platform at an unbeatable price. It simplifies financial tasks with automated invoicing and payment tracking, enabling business owners to focus more on their core operations and less on manual bookkeeping.

Key Benefits

- Free invoicing and accounting that’s perfect for small businesses

- Easy integration with bank accounts and payment processing

- Customizable invoice templates to suit your business branding

- Receipt scanning for effortless expense tracking

- Real-time financial reporting to stay on top of your business finances

Pricing

Wave’s pricing structure is exceptionally simple. It offers a free Starter plan with basic invoicing and accounting features. The Pro Plan is $16 monthly for businesses needing more advanced capabilities.

Pros & Cons

Pros

Cons

8) Zoho Books – Best Accounts Receivable Software for the Zoho Suite

Overview

Zoho Books is a cloud-based accounting solution offering robust AR capabilities. It’s ideal for businesses already invested in the Zoho ecosystem, providing seamless integration and familiar navigation.

Key Benefits

- Seamless integration with the Zoho ecosystem, enhancing productivity

- Automated payment reminders to expedite receivables collection

- Customizable invoice templates to reflect brand identity

- In-depth financial reports for better decision-making

- Multi-currency handling to support global business transactions

Pricing

Zoho Books pricing starts at $12 per organization per month. They offer Professional, Premium, Elite, and Ultimate plans with expanded features for growing businesses.

Pros & Cons

Pros

Cons

9) Bill – Best Accounts Receivable Software for Simplified Invoicing

Overview

Bill.com is a cloud-based financial platform that simplifies both accounts receivable (AR) and accounts payable (AP) processes. Its focus on user-friendly invoice creation and payment collection makes it an excellent option for businesses seeking a straightforward AR solution.

Key Benefits

- Easy-to-create, professional invoices

- Automated invoice sending and reminders

- Multiple payment options for customers (ACH, credit card)

- Syncs with popular accounting software

- Offers both AR and AP solutions for streamlined workflows

Pricing

Bill.com’s pricing for Accounts Receivable falls into two tiers: $45 per user per month for the Essentials plan and $55 per user per month for the Team plan.

Pros & Cons

Pros

Cons

10) Sage50 Cloud – Best Accounts Receivable Software for Small Business Accounting Flow

Overview

Sage50 Cloud is a powerful accounting software tailored for small businesses, providing robust accounts receivable features along with comprehensive financial management tools. Sage Business Cloud Accounting combines the convenience of the cloud with the depth of desktop accounting software, offering a seamless integration of business processes and financial tracking.

Key Benefits

- Intuitive interface that simplifies financial management for small businesses

- Robust invoicing and payment tracking to streamline accounts receivable

- Secure cloud access enables financial monitoring from anywhere

- Detailed financial reporting for informed business decisions

- Integration capabilities with other business applications for a holistic approach

Pricing

Pricing for Sage 50cloud starts at $58.92 per user per month, with additional tiers like Premium Accounting and Quantum Accounting available to provide a full Sage 50 experience tailored to the business’s specific needs.

Pros & Cons

Pros

Cons

11) Invoiced – Best Accounts Receivable Software for B2B Invoicing Network

Overview

Invoiced is an AR automation platform designed specifically for B2B businesses. It offers features for managing complex B2B invoicing scenarios, including payment plans, subscriptions, and its extensive invoicing network for streamlined transactions.

Key Benefits

- Robust B2B-specific invoicing and payment features

- Automate payment reminders and collections tasks

- Access to the Invoiced Network for faster B2B payments

- Advanced reporting and analytics for AR insights

- Integrates with popular accounting and CRM systems

Pricing

Invoiced doesn’t provide fixed pricing tiers, but it offers customized plans starting at $400 per month, with annual discounts available. Contact its sales team for a quote tailored to your business.

Pros & Cons

Pros

Cons

What Are Accounts Receivable Software Tools?

Accounts receivable (AR) automation software tools are designed to streamline and automate invoicing customers, collecting payments, and managing outstanding balances. These financial tools help businesses get paid faster, reduce errors, and improve their cash flow.

Beyond the core features mentioned above, many AR automation tools offer additional benefits that can significantly impact your business. These include:

- Customer Portals: Provide clients with a secure online space to view invoices, make payments, and manage their account information, improving customer experience and reducing administrative burdens.

- Dispute Resolution Tools: Offer built-in features to manage and resolve payment disputes, streamlining communication and keeping the AR process flowing smoothly.

- Advanced Analytics: Powerful reporting dashboards give you deeper insights into your AR performance, helping you identify bottlenecks, forecast cash flow, and make data-driven decisions.

When choosing AR automation software, consider the core invoicing and payment features and these additional capabilities, as they can significantly impact your overall AR efficiency and customer experience.

How Can AR Automation Software Tools Benefit You?

Accounts receivable management software offers many benefits that can transform your accounts receivable processes. Here’s how:

- Improved Cash Flow: Get paid faster and more consistently with automated invoicing, payment reminders, and streamlined collections. This increased cash flow fuels your business growth and strengthens financial stability.

- Enhanced Accuracy: Reduce human error in invoicing and calculations, preventing costly mistakes and disputes. This increased accuracy improves your financial records and builds trust with customers.

- Increased Productivity: Free your team from tedious manual tasks, allowing them to focus on more strategic work. This boost in productivity can save you time, reduce costs, and even enable you to scale your business without adding as much overhead.

Beyond these direct benefits, AR automation software can also enhance your customer relationships. Features such as automated reminders sent in a friendly tone and convenient online payment options make things easier for your clients, strengthening customer satisfaction and loyalty.

Buyers Guide: How We Conducted Our Research

To identify the best accounts receivable software companies, our research was anchored in a meticulous evaluation process considering a broad spectrum of factors crucial for businesses seeking efficient and reliable accounts receivable solutions.

Initially, we conducted an extensive market survey to uncover a diverse range of software tools, followed by an in-depth analysis of their features, pricing, and user feedback from various platforms. This approach enabled us to assess each tool’s value proposition, focusing on critical functionalities such as automated invoicing, payment tracking, and integration capabilities with other business systems.

Moreover, we paid particular attention to user reviews and firsthand experiences to understand the practical implications of using each software tool in real-world scenarios. This was complemented by examining the support structures in place, including customer service responsiveness and community engagement, as well as each tool’s commitment to security, compliance, and innovation.

By synthesizing this information, we aimed to provide a comprehensive and balanced guide highlighting the strengths and potential limitations of the top AR automation solutions available, catering to the varied needs of businesses across industries.

Final Thoughts on AR Automation Software

Investing in any of my listed top accounts receivable software is a smart move for you and your business, especially if you want to streamline its invoicing and payment processes.

AR automation software saves you time, reduces errors, improves cash flow, and enhances customer relationships.

When choosing the right accounts receivable software, carefully consider your business’s features, pricing, and specific needs. The options we’ve explored in this guide provide a great starting point, offering diverse solutions to fit a variety of businesses.

By taking advantage of the resources and insights, you’ll be well-equipped to find the perfect AR automation tool to transform your financial processes.

Frequently Asked Questions (FAQs)

Can AR automation software integrate with my existing accounting system?

Many popular AR automation tools offer integrations with common accounting software, such as QuickBooks, Xero, and others. To ensure a seamless workflow, make sure to check the compatibility of your chosen software with your existing systems.

What are the key features to look for in AR automation software?

Core features typically include automated invoicing, payment reminders, online payment processing, reporting, and customer portals. Consider your specific business needs to determine which additional features (like advanced analytics or dispute resolution tools) would be most beneficial.

How secure is AR automation software?

Reputable AR automation providers prioritize data security using encryption, secure servers, and regular security audits. Look for certifications like SOC 2 compliance, which indicates adherence to strict data security standards.

Is AR automation software challenging to implement?

Most modern AR automation software solutions are designed with user-friendliness in mind. Many providers offer guided setup, onboarding resources, and ongoing support to ease the implementation process.

Can AR automation software help me handle international clients and currencies?

Some enterprise-level AR solutions offer multi-currency support and features suitable for international transactions. Be sure to inquire about specific capabilities if you frequently invoice clients in different countries.

Are there free accounts receivable software?

Absolutely! Several accounts receivables software options offer free plans or trials, providing businesses with basic AR automation features. However, free plans generally have limited features or user capacity compared to paid options.