Small Business Finances 101: How to Manage Your Finances Effectively

Are you a small business owner struggling with finances?

I created this “Small Business Finances 101” guide as the go-to resource for entrepreneurs and small business owners seeking financial clarity. This guide holds a lot of information that will empower you with the essential information to make informed decisions about budgeting, taxes, cash flow management, etc.

No more feeling overwhelmed by quoting complex financial terms or figuring out how much money your company should set aside each month as savings. Instead, master understanding the fundamentals of managing your own money so that you can focus on building an even bigger and better future for yourself and your business!

Read through this guide and manage your finances the right way. Happy reading!

What Are Small Business Finance Basics?

When you’re running a small business, understanding the basics of finance is crucial. Small business finance involves managing your company’s money, including handling cash flow, expenses, profits, and investments.

It’s about tracking what comes in and goes out, ensuring you have enough cash to cover your operations and strategically plan your business’s financial future.

This is relevant to you as it directly impacts your business’s viability and growth potential. Effective financial management is the backbone of your business’s success.

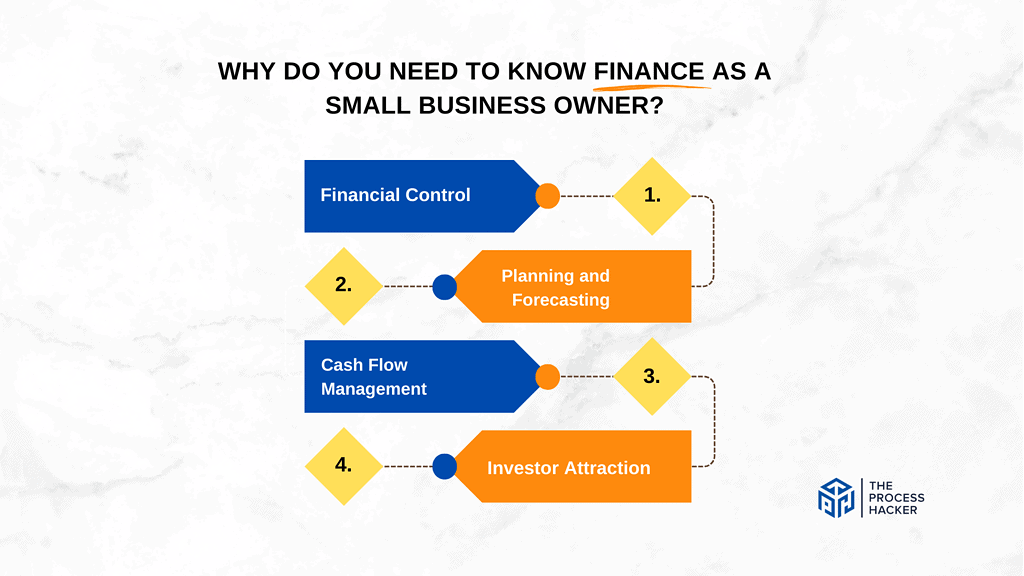

Why Do You Need to Know Finance As A Small Business Owner?

As a small business owner, having a solid grasp of your finances is not just an option—it’s necessary! Why, you ask? Well, I’m glad you did.

- Financial Control: Understanding your finances gives you control over your business’ destiny. It allows you to make informed decisions and steer your business in the right direction.

- Planning and Forecasting: With a clear picture of your financial health, you can better plan for the future and forecast potential growth or challenges.

- Cash Flow Management: Cash flow is the lifeline of your business. Knowing how to manage it effectively prevents the risk of insolvency.

- Investor Attraction: Investors are more likely to put their money in a business that has its finances in order. Having this business finance skill could be the difference between securing funding or not.

By learning and applying effective finance management techniques, you set yourself up for success. I’m here to guide you through this process with practical, easy-to-understand methods. With my approach, you’ll grasp the basics and learn how to apply them to benefit your business.

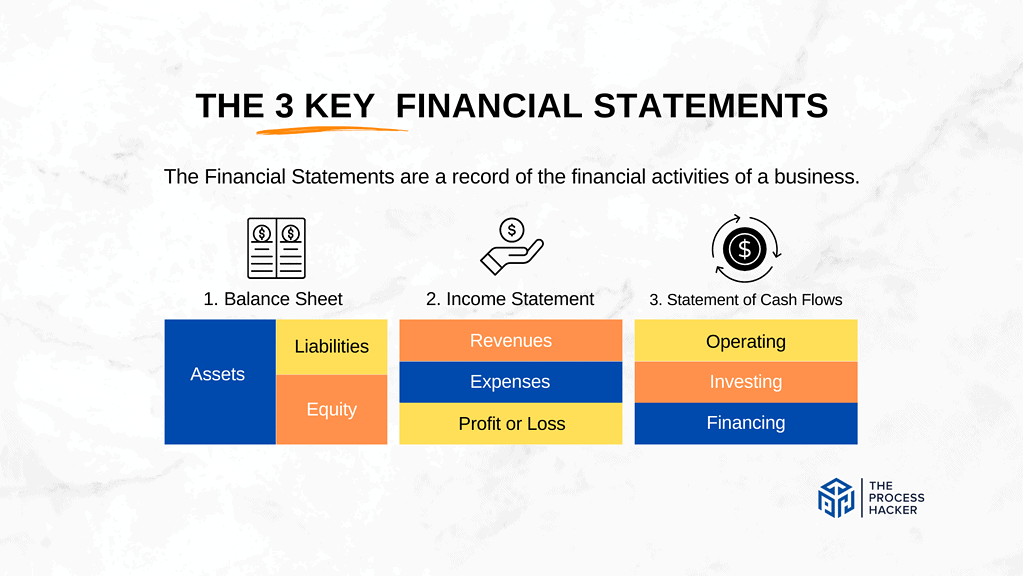

What Are The Main Financial Statements?

Your financial statements are like your company’s report card—they show how well your business performs financially. Understanding these statements is key to making sound business decisions.

Here are the three main financial statements you need to be familiar with:

- Profit and Loss Statement (P&L) or Income Statement

- Cash Flow Statement

- Balance Sheet

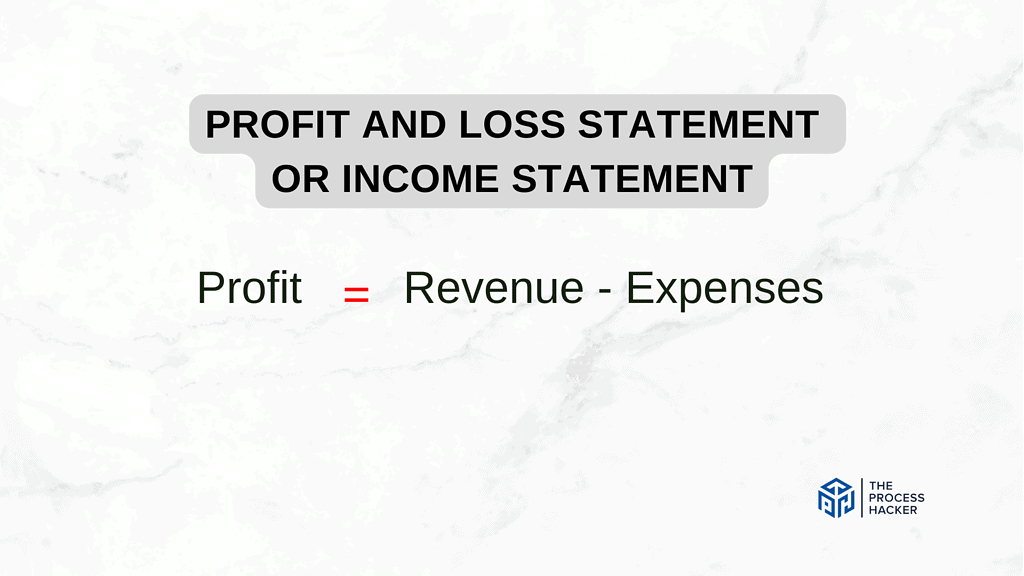

Profit and Loss Statement or Income Statement

An income statement (aka Profit and Loss Statement) is a record of profit, income, and expenses for a given period of time, usually monthly or annually:

- Revenue: The earnings generated from selling goods or services to your clients.

- Expenses: The costs associated with producing, selling, and delivering services, including costs for labor, materials, rent, and taxes.

- Profit or Net Income: The financial gain that a business generates after deducting expenses from the revenue generated from sales.

- Profit Margin: The percentage of the company’s revenue kept as profit.

By tracking income and expenses in an income statement, small businesses can gain a better understanding of their profitability. This lets them properly plan, forecast, and strategize for the upcoming financial year.

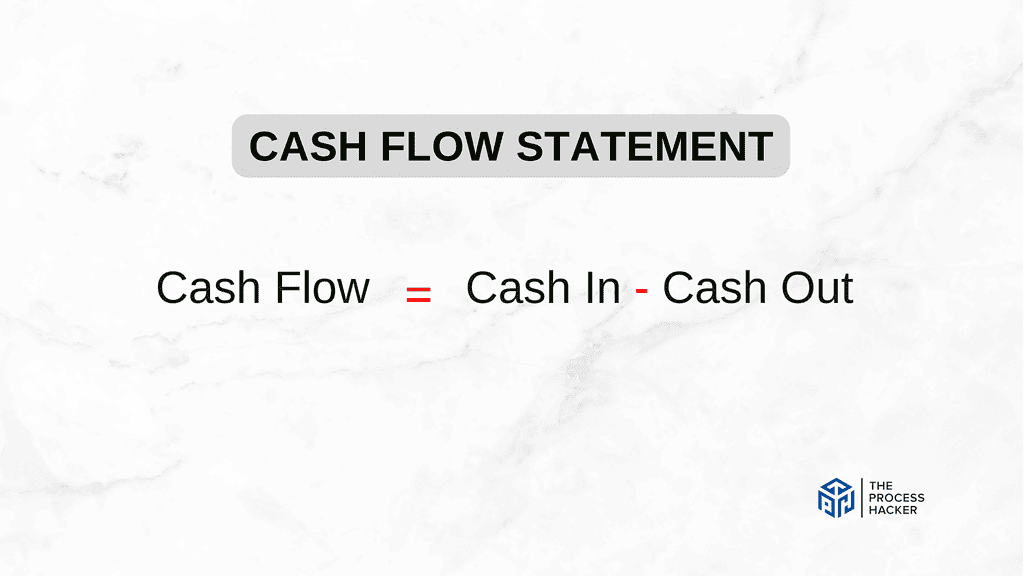

Cash Flow Statement

The cash flow statement provides a summary of the money coming in or leaving your small business bank accounts over a set period of time:

- Cash Flow: The net amount of money that flows in and out of your company. You should have a positive cash flow.

- Cash Balance: The amount of money that a company has available in the bank to offset any unplanned expenses or invest in new products, projects, employees, etc.

- Cash Reserve Runway: The cash balance divided by your monthly average monthly expenses indicates how much time in months you have till you run out of cash.

Cash flow statements provide critical insight into cash balances, especially for small businesses with limited liquidity and cash reserves. Establishing a dedicated free checking account is a fundamental step, as it helps separate personal and business finances, streamlining expense tracking and financial management. As a result, you can improve operational efficiency and invest money into new opportunities.

The Cash Flow Statement gives visibility on the cash generated from day-to-day activities and investments, enabling owners to better understand how cash is being earned and spent and identify any cash flow problems that may arise.

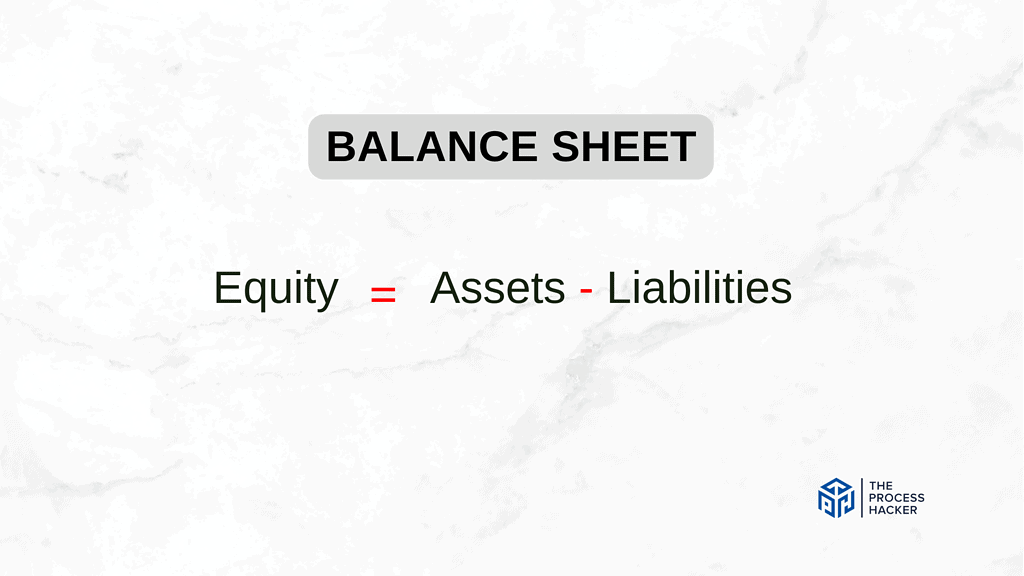

Balance Sheet

The balance sheet is a statement of your company’s financial position, which consists of assets, liabilities, and equity:

- Assets: Refer to what the business owns, such as cash, land, equipment, and inventory.

- Accounts Receivable (AR): An asset indicating the amount of money owed to you from your customers. Check out these AR automation tools!

- Liabilities: The debts the company owes to other parties, such as payroll taxes, outstanding supplier payments, or small business loans.

- Accounts Payable (AP): A liability indicating the amount of money you owe to vendors and suppliers. Check out these AP automation tools!

- Equity: The balance left once liabilities are subtracted from assets, which indicates how much the shareholders own in relation to the other stakeholders.

The Balance Sheet provides a snapshot of the organization’s net worth at any given time. By looking at past balance sheets or comparing balance sheets over time, you can understand what you own in the business.

Further, investors or lenders can know about a business’s change in wealth and trends over time. This information allows them to make informed decisions when investing or loaning money to an organization.

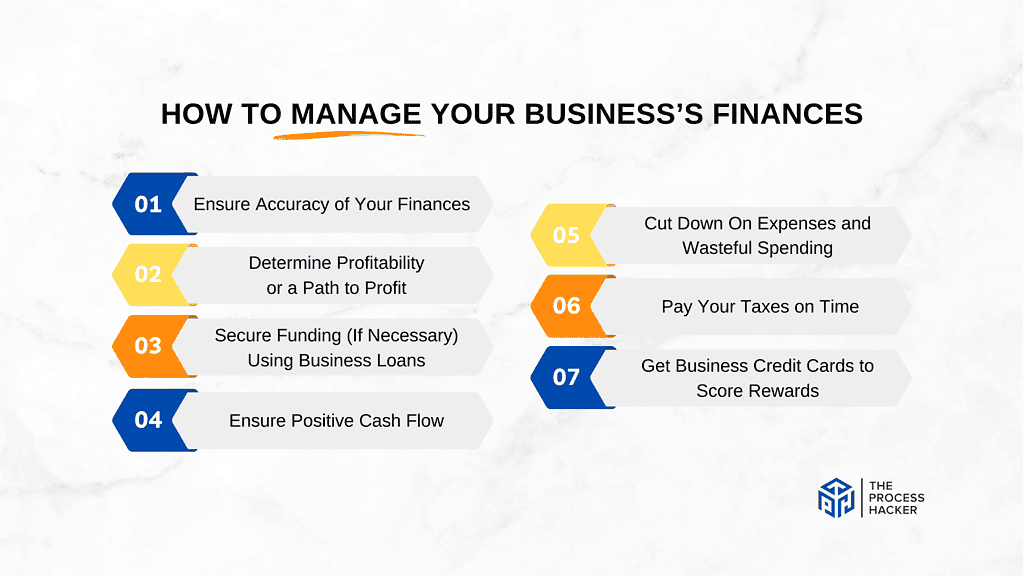

How to Manage Your Business’s Finances

Managing your business’s finances might seem daunting, but with the right approach, it can be simplified into a practical and manageable process. I will walk you through a step-by-step method explicitly designed for small business owners like you.

This process will help you gain control, increase profitability, and secure the financial health of your business. Let’s break it down into clear, actionable steps:

- Ensure Accuracy of Your Finances

- Determine Profitability or a Path to Profit

- Secure Funding (If Necessary) Using Business Loans

- Ensure Positive Cash Flow

- Cut Down On Expenses and Wasteful Spending

- Pay Your Taxes on Time

- Get Business Credit Cards to Score Rewards

Now that you have an overview of these steps let’s delve deeper into each one. I’ll guide you through the specifics, offering tips and insights to help you apply these strategies effectively in your business.

By the end of this tutorial, you’ll have a strong foundation for managing your small business finances confidently and efficiently. Let’s get started!

Ensure Accuracy of Your Small Business Finances

Ensuring the accuracy of your financial records is like laying a solid foundation for a building. It’s essential for the stability and growth of your business. More accurate financial data can lead to better decision-making, compliance issues, and missed opportunities.

So, how do you achieve this accuracy?

- Record All Transactions

- Do Regular Bookkeeping of Income and Expenses

- Reconcile Bank Statements

- Understand Your Numbers to Ensure Accuracy

- Seek Professional Help if Necessary

By ensuring the accuracy of your financial data, you’ll be able to make informed decisions, plan for the future, and steer your small business toward success. Remember, accurate finances are not just a regulatory requirement but a tool for your business growth.

Let’s start this journey with a clear and accurate financial picture.

Determine Profitability or a Path to Profit

Determining profitability or creating a path to profit is the next crucial step in managing your business finances. Profit is not just about survival; it’s also about thriving and growing.

- Determine How You Will Get Revenue or Make Money

- Understand Your Fixed and Variable Costs

- Analyze Your Profit Margins

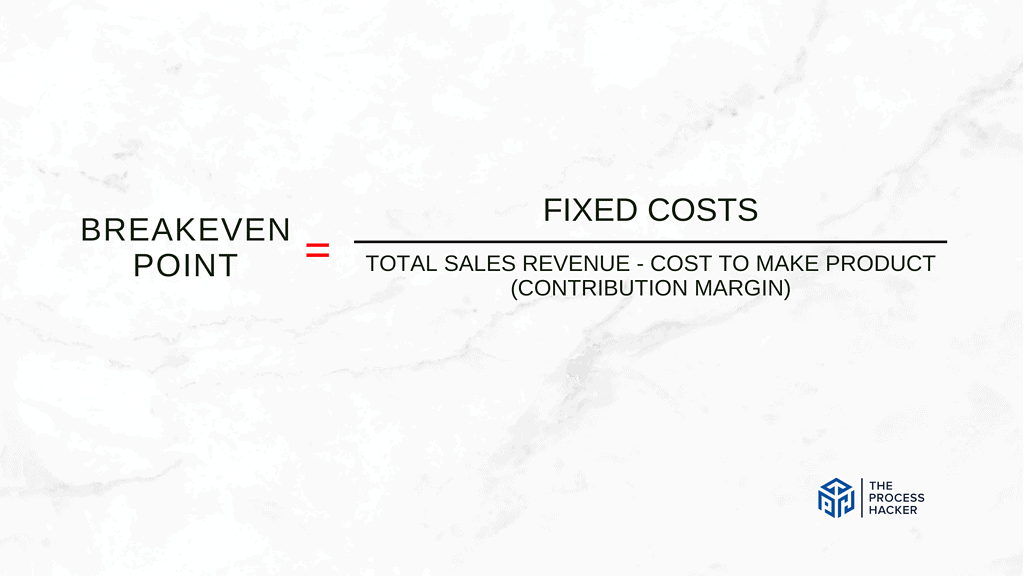

- Create a Profit Plan to Get to Break Even

- Monitor and Adjust the Plan

Secure Funding (If Necessary) Using Business Loans

At some point in your entrepreneurial journey, you might need additional funding to grow or sustain your business. This is where business loans or funding can play a pivotal role.

Securing a small business loan might seem intimidating, but it’s a common and viable option for many small businesses. Let me guide you through how to approach this:

- Assess Your Funding Needs

- Prepare Your Financial Statements

- Build a Strong Business Plan

- Understand Different Loan Options

- Check Your Credit Score

- Compare Lenders

- Prepare for Collateral and Guarantees

- Apply for the Bank Loan

Securing a loan is a strategic move. It should align with your business finance goals and capacity. I’m here to help you navigate through this process, ensuring you make informed decisions that benefit your business’s long-term financial health.

Also, consider establishing and utilizing business tradelines, which are credit accounts listed on your company’s credit report, such as credit cards, lines of credit, or supplier accounts. These tradelines can enhance your business credit score, demonstrate creditworthiness, and improve your ability to secure future financing.

By responsibly managing these accounts, you showcase financial reliability to potential lenders and business partners, making it easier to obtain favorable loan terms and successfully grow your business.

Ensure Positive Cash Flow

Ensuring positive cash flow is crucial to managing your finances. Cash flow is the movement of money in and out of your business. You have positive cash flow when more money comes in than going out. Here’s how you can ensure it:

- Understanding Your Cash Flow

- Increase Income or Cash Entering Your Bank Account

- Reduce Costs or Cash Leaving Your Bank Account

- Manage Accounts Receivables (AR) and Accounts Payables (AP)

- Create a Cash Flow Forecast

Remember, cash is king in business. Even if you’re profitable, you could still run into trouble if you don’t manage your cash flow effectively. So, take these steps to ensure positive cash flow and financially stabilize your business.

Now, let’s move on to the final step: planning for the future.

Cut Down On Expenses and Wasteful Spending

Cutting down expenses and wasteful spending is a smart strategy for managing your business’s finances. Start by reviewing your current expenses for establishing internal financial protocols.

This might involve renegotiating contracts with suppliers, reducing energy costs, or eliminating unnecessary services. Remember, even small changes can add up over time, leading to significant savings and improved financial health for your business.

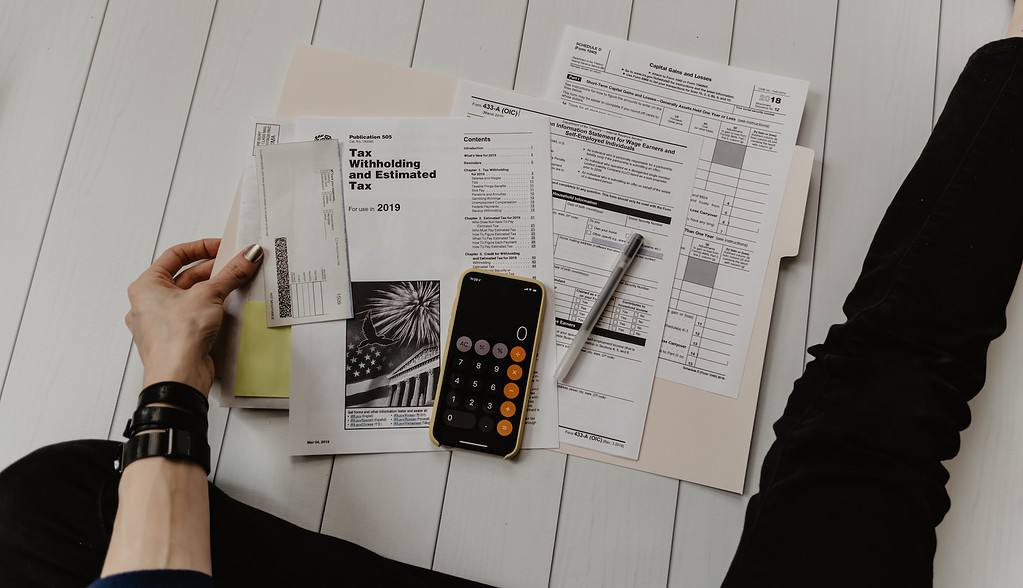

Pay Your Taxes on Time

Paying your taxes on time is essential to managing your business finances. To do this, you’ll need to understand your tax obligations, which may include income tax, sales tax, and payroll tax, among others.

Use a calendar to keep track of important tax deadlines, and consider working with a tax professional to ensure accuracy. Timely tax payments can help you avoid costly penalties and keep your business in good standing with the authorities.

Get Business Credit Cards to Score Rewards

Getting a business credit card is another smart way to manage your business finances and build business credit. Not only can it help separate your personal and business expenses, but it can also earn you valuable rewards.

Look for a card that offers rewards like cash back or travel points in categories where you spend the most. Just remember to pay off your balance each month to avoid interest charges. This way, you can reap the benefits without incurring unnecessary debt.

Key Considerations For Properly Managing Finances

In addition to the steps mentioned above, there are a few more key considerations for effectively managing your finances.

Firstly, it’s crucial to maintain a cash reserve. Unexpected expenses can sometimes arise, and having a safety net can be a lifesaver. Treat your cash reserve as a fixed cost and contribute to it regularly, just like you would pay any other bill.

Consider investing in financial management software. This can streamline your bookkeeping process, making tracking income, expenses, and tax obligations easier. It also helps you gain a clear picture of your financial health at a glance.

Finally, remember that managing finances is not a one-time task but an ongoing process. Regularly review and adjust your financial strategies as your business grows and evolves. This way, you can stay on top of your financial game and ensure your business thrives.

Taking it to the Next Level: Get Quickbooks Accounting Software

If you’re ready to take your finances to the next level, consider investing in a tool like QuickBooks. This accounting software is designed specifically for small businesses, making it easier than ever to manage your finances.

QuickBooks offers a range of features that can significantly enhance and automate your financial management. It allows you to track income and expenses, maximize tax deductions, run payroll, send invoices, accept payments, and even forecast future business performance. It also integrates with many other business tools, making it a versatile solution for all your financial needs.

Remember, effectively managing your finances is about more than just keeping track of money coming in and going out. It’s about understanding your financial health, planning for the future, and making informed decisions to drive your business forward.

With QuickBooks, you get all these capabilities in one place, giving you more time to focus on what you do best – running your business.

Alternative: Get An Accountant and Bookkeeper

Hiring an accountant and bookkeeper can be a game-changer if you want to enhance your financial management beyond the basics. While software like QuickBooks can help streamline your financial tasks, there’s no substitute for professional expertise in managing your business’s finances.

A bookkeeper can handle the day-to-day financial tasks of your business, like recording transactions, invoicing customers, and paying bills. This can free up your time to focus on other business aspects. An accountant, on the other hand, can provide strategic financial advice. They can help with tax planning, financial forecasting, and business growth strategies.

Remember, as your business grows, so do your financial responsibilities. Having a professional by your side can provide peace of mind, knowing your finances are in good hands, allowing you to focus on what you do best – growing your business.

Final Thoughts on Business Finance for Small Business Owners

Managing your finances effectively is crucial to running a successful business!

From tracking income and expenses to maintaining a cash reserve, investing in financial management software, or even hiring a professional accountant or bookkeeper, there are several strategies you can employ to stay on top of your financial game.

Remember, the goal isn’t just to keep your business afloat and make informed decisions that drive growth and profitability. Your finances reflect your business’s health, and understanding them can give you the insight needed to steer your business automation in the right direction.