QuickBooks Online Review 2024: Best Accounting Software?

Tired of tracking your business expenses in those crusty spreadsheets?

Looking for software to track your accounting and expenses for you?

QuickBooks Online is the perfect cloud-based solution for small businesses, with features designed to help you track your finances in real time. I personally use it to manage my business finances and business trip bills and recommend it to clients any chance I get!

If you purchase through our partner links, we get paid for the referral at no additional cost to you! For more information, visit my disclosure page.

From invoices to payroll, this comprehensive system can make business finances a breeze. And its user-friendly interface and live bookkeeping support make it easy to use – even if you’re not an accounting whiz!

With QuickBooks Online, you can easily export data into Excel spreadsheets and create detailed reports to help you stay organized and on top of your finances.

In this QuickBooks review, I share why I love QuickBooks for accounting and bookkeeping. As I have been using it for years, I want to help you make the right decision.

Plus, try it free for 30 days, so there’s no risk in trying it out without spending any money upfront.

Download Quickbooks Online now and experience fast, accurate accounting and bookkeeping that’ll save you time – guaranteed!

QuickBooks Pros & Cons

When considering accounting software, it’s essential to weigh QuickBooks’s pros and cons against your specific needs and preferences to make the right decision.

Pros

Cons

QuickBooks Pros

- Simplifies Financial Management: QuickBooks Online offers an intuitive, user-friendly platform that can streamline your financial management. This translates into less time spent on bookkeeping and more time available for growing your business.

- Comprehensive Reporting: QuickBooks provides a wide range of customizable reports that give insight into your company’s financial health. This empowers you to make sound financial decisions based on real-time data.

- Scalability: QuickBooks Online can help you grow your business. Whether you’re a small startup or a large enterprise, QuickBooks can handle your increasing accounting needs without requiring you to switch platforms.

- Simplifies Tax Preparation and Compliance: Gone are the days of frantic tax season scrambles. QuickBooks Online alleviates tax time stress by tracking expenses, automating sales tax calculations, and helping you with tax deductions. Lastly, my accountant connects directly to my QuickBooks account to prepare my taxes.

QuickBooks Cons

- Higher Learning Curve for Non-Accountants: While QuickBooks Online is designed for ease, those new to digital accounting may initially find it slightly challenging. However, after getting used to the interface and features, you will be able to navigate your finances more quickly and confidently.

- Occasional Slow Performance: Some users have reported slow performance during peak usage times. But remember, this can be mitigated by ensuring your system meets the recommended internet requirements and routinely clearing your cache.

Quick Verdict – Is QuickBooks Worth the Money?

After spending years managing my business finances with QuickBooks Online, I can confidently say that, yes, it is worth the money.

QuickBooks Online is a resounding yes for me. Its comprehensive features, intuitive interface, and scalability make it an indispensable financial tool for businesses of all sizes.

Its ability to simplify complex financial tasks sets QuickBooks apart from other accounting software. It offers comprehensive reporting tools that provide real-time insights into your company’s financial health, empowering you to make informed decisions. Moreover, its user-friendly platform makes financial management less time-consuming, freeing valuable time to focus on growing your business.

You might think that QuickBooks Online is too expensive compared to other options in the market. However, considering its wide range of features and benefits, the value provided pays for itself through improved efficiency and better financial management.

While QuickBooks has much to offer, there is a slight learning curve when first starting out. However, with some practice and training, I’m sure that you or a member of your team can figure it out. Further, some users, including myself, have found slow performance issues, which can be resolved by not having too many tabs open and having a solid internet connection.

If you’re looking for a reliable, comprehensive, and user-friendly accounting solution, try QuickBooks Online.

With its robust features and scalable platform, it could be the game-changer your business needs to streamline financial management and drive growth!

Who is QuickBooks for?

Below are some examples of who can benefit from QuickBooks Online:

You’ll love QuickBooks if:

- You’re a small to medium-sized business owner: QuickBooks Online simplifies complex accounting tasks, making it easier to manage your finances. It’s scalable, so it grows with your business.

- You need real-time financial insights: With its comprehensive reporting tools, QuickBooks Online provides up-to-date information about your company’s financial health, helping you make informed decisions.

- You value time efficiency and need a dedicated account team: The user-friendly interface of QuickBooks makes financial management less daunting and time-consuming, leaving more time for you or the accounting professionals to focus on other aspects of your business.

You won’t love QuickBooks if:

- You’re on a tight budget: While QuickBooks Online offers a wealth of features and benefits, it may be considered expensive compared to other options in the market. However, the cost should be regarded as an investment in your future.

- You’re not tech-savvy: First, starting out with QuickBooks Online can be a learning curve. However, with a bit of practice and some training, most users find it becomes easier over time.

- You don’t have a reliable internet connection: QuickBooks Online requires a stable internet connection for optimal performance. Some users have reported slow performance during peak usage, but this can be resolved by ensuring your system meets the recommended requirements.

What is QuickBooks?

QuickBooks is a comprehensive, cloud-based accounting software designed to help businesses manage their finances efficiently. It offers a variety of features, such as invoicing, expense tracking, managing cash flow, and detailed financial reporting.

What is the key benefit of having QuickBooks?

The key benefit of having QuickBooks Online is its ability to simplify complex financial tasks, saving you time and effort.

Its comprehensive reporting tools provide real-time insights into your company’s financial health, empowering you to make informed decisions. Moreover, it offers scalability, meaning it can grow with your business, accommodating increasing accounting needs without requiring you to switch platforms.

How does QuickBooks work?

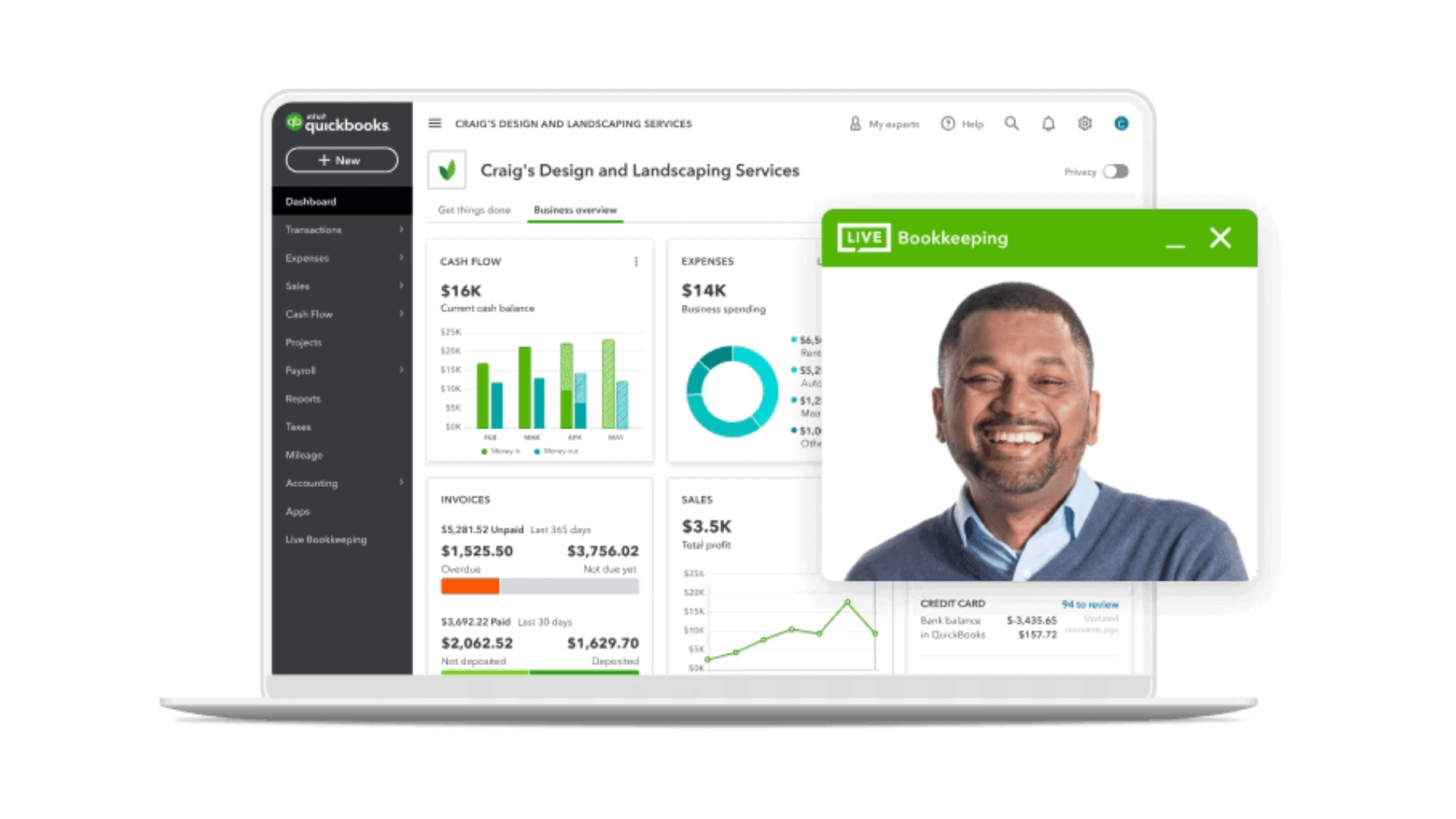

QuickBooks Online works by providing a platform where you can manage all your business finances. It comes with a dashboard that gives an overview of your business’s financial status at a glance.

You can create and send invoices, track income and expenses, manage bills, and run various financial reports. Additionally, this all-in-one software integrates with other business tools and applications, creating a seamless workflow.

How is it different from competitors?

QuickBooks’s ease of use, comprehensive feature set, and scalability set it apart from its competitors.

While many accounting software options offer basic bookkeeping features, Intuit QuickBooks Online goes beyond providing tools for you to manage inventory, project profitability tracking, and tax preparation.

Its user-friendly interface is also designed with non-accountants in mind, making it accessible to business owners without accounting experience. Furthermore, its capacity to scale with your business remains valuable as your accounting needs evolve.

Reasons I Recommend QuickBooks to Everyone

#1) Enhanced Decision-Making with Real-Time Financial Insights

The immediate access to critical financial data is more than a convenience; it’s a game-changer in decision-making.

QuickBooks Online gave me a lens into my business’s financial health that I didn’t know I needed. Suddenly, I was spotting trends, tracking my expenses with incredible precision, and monitoring the company’s cash flow patterns—all in real time.

This benefit is not just about having information; it’s about the transformative power of that information. Decisions become calculated, confidence replaces doubt, and strategies become data-driven.

For instance, identifying my business’s project profitability aspects became straightforward, allowing me to allocate resources more effectively. You can feel and measure this level of insight—the difference in my balance sheets and peace of mind speaks volumes.

#2) Unparalleled Organization Saving Time & Reducing Stress

I can’t overstate the relief of having every financial transaction organized immaculately, from invoices to expenses.

The seamless synchronization with bank accounts and third-party applications meant no more manual entries, virtually eliminating the risk of errors that could lead to significant headaches.

This organizational prowess proved invaluable during the tax season. What was once a source of dread became a smooth process, with every necessary document and figure available at my fingertips.

My saved hours allow me to focus on strategic initiatives rather than being buried in administrative tasks. This efficiency wasn’t just a boon for my business operations but a transformative factor for my work-life balance.

#3) Flexibility & Accessibility for the On-the-Go with the Mobile App

Intuit QuickBooks Online’s mobile app allowed me to maximize my time. Whether I was traveling, meeting with clients, or working from home, my business’s financial heartbeat was always a secure login away from my mobile app or the QuickBooks desktop pro.

This accessibility extended beyond just checking in. I was issuing invoices, processing payments, and even running payroll while waiting for my flight at the airport lounge.

The cloud-based nature of QuickBooks Online meant I wasn’t just working; I was operating at full capacity, irrespective of location, with just a mobile app!

What You Might Not Like about QuickBooks

#1) Cost Can Be a Consideration for Small Businesses to Medium-Sized Businesses

QuickBooks Online offers various plans. While these cater to different business sizes, the costs might be problematic for freelancers, independent contractors, or small businesses on tight budgets.

As my small business grew, I needed to upgrade to a more expensive plan to access additional features, which, although incredibly useful, impacted my overhead expenses.

Especially for smaller businesses, this cost factor is crucial to consider. When I was freelancing, I remember being hesitant about the recurring expenses.

However, weighing this against the value it brings to your business is important. The business automation, time saved, and insights gained were indispensable, justifying the investment. Still, it’s a balance small business owners need to assess based on their unique financial situation.

#2) Learning Curve

While QuickBooks Online is designed to be user-friendly, there can be a learning curve when starting out with the software. This is particularly true if you’re not tech-savvy or new to digital accounting tools.

It took time for me to get used to all the features and understand how to use the software to its full potential. However, after spending some time exploring and using the platform, the process became much more intuitive.

QuickBooks Online Pricing

QuickBooks Online accommodates various business sizes and needs with its tiered pricing structure, starting at $18 monthly for the Simple Start plan. For those needing more comprehensive features, QuickBooks also offers Essentials for up to three users, and Plus plans for up to five users.

The prices can vary based on additional functionalities and services included. These options ensure businesses can access financial tools aligned with their budget and operational requirements.

QuickBooks: Key Features Breakdown

Let’s break down the key features of QuickBooks and delve into the details of each feature:

Invoice Management

This Intuit QuickBooks Online feature is designed to streamline and automate pay bills processes. This system isn’t just about sending out bills.

It encompasses creating customized, professional services invoices, scheduling recurring payments, and even allowing customers to pay directly through the invoice using an “Intuit Payments” or QuickBooks Payments feature. This often leads to faster turnaround time for accounts receivable.

What makes QuickBooks’ invoice management special is its third-party app integrations within the larger financial ecosystem. It positions a business to accelerate its accounts receivable, improve cash flow bank reconciliation, and enhance customer experience, all through a seamless, automated process.

The ability to track invoice status, customize invoices, send payment reminders automatically, and link directly to accounts means less manual follow-up and reduced chances of error — a unified, efficient approach.

From my personal experience, adopting QuickBooks Online’s invoice management was a turning point. This wasn’t just a minor operational shift but an enhancement in professional presentation and client relationships.

Watching overdue payments diminish on my dashboard clearly indicates improved cash flow, directly impacting my business’s financial health and peace of mind. The feature allowed me to step back from constant invoice oversight and refocus that energy on strategic business growth activities.

Expense Tracking

Expense Tracking is another powerful feature that makes it easy for businesses to track where their money is going. It offers a systematic approach to record and categorize business expenses and bank statements.

The feature stands out because it can connect directly to your bank account, credit card transactions, PayPal, or Square to automatically import and categorize transactions. This real-time tracking helps maintain accurate financial records and simplifies tax filing.

The Expense Tracking feature has significantly streamlined my financial management. It eliminated the need for manual entry, reduced errors, and provided a clear overview of my business expenses. This level of detail and organization has made budgeting and financial planning much more efficient for me.

Bill Management

Bill management centralizes and automates how you handle your accounts payable, ensuring you never miss a payment and maintain a good relationship with vendors. It directly integrates with your financial accounts. Then, you can set up and schedule bill payments, track due dates, and even allocate expenses to particular projects or categories.

The strength of QuickBooks’ bill management lies in its seamless integration with other basic accounting concepts. It’s not just about paying bills; it’s about streamlining the entire financial management process. This holistic approach to managing payables positions even a small business for accurate financial forecasting.

The impact was immediate as I could track bills with different due dates, and payment methods significantly lightened the mental load. Furthermore, assigning bill payments to specific projects allowed me to see the actual cost of each project. The feature instilled a proactive approach to my personal finance, replacing the reactive nature I’d previously been accustomed to.

Financial Reports

Financial Reports allows users to generate detailed reports. These include profit and loss statements, balance sheets, cash flow statements, and tax summaries.

This feature is special due to its customizability and depth of analysis. You can tailor reports to your needs and gain insights into your business’s financial health. Plus, the ability to create visual representations like graphs and charts makes interpreting your company data easier.

From my experience, the Financial Reports feature has helped me improve my financial decision-making. It provides a comprehensive view of my business’s financial status, which has been crucial in planning and budgeting. The ability to quickly generate reports has also made meetings with my accountant and tax filing processes much smoother.

Inventory Tracking

With this feature, you can manage various aspects of your inventory – from creating purchase orders for new stock to tracking your goods as they’re sold and shipped. QuickBooks automatically updates inventory management levels with every purchase and sale, provides notifications when stock is low, and calculates the cost of goods sold, contributing to more accurate profit analyses.

The beauty of QuickBooks’ inventory tracking is how it integrates with your entire bookkeeping operation. It’s not just a standalone track inventory system. This feature stands out for its ability to handle multiple items and track their details, including cost, sales revenue, and inventory replenishment, providing a panoramic view of your business’s inventory health. It integrates well, as you can see how you track inventory and how it affects your finances, from cash flow to tracking project profitability.

When you integrate track inventory management, you will get more control over your business. The automated updates following sales and purchases, coupled with low stock alerts, mean you can say goodbye to the days of guesswork and last-minute orders that often led to either stock shortages or excess.

Further, you can optimize purchase plans and negotiate better terms with suppliers, saving money in the long run. This feature will bring predictability and the ability to strategize for growth rather than merely managing crises.

Sales Tax

The Sales Tax feature helps you simplify calculating, collecting, and remitting sales taxes. It allows you to set up tax rates, apply them to invoices, and track how much tax has been collected.

What makes this feature stand out is its finance automation capabilities. Once set up, QuickBooks Online automatically calculates the correct sales tax for each transaction based on the sale details. This eliminates the need for manual calculations and reduces the risk of errors.

The Sales Tax feature has dramatically simplified my tax management process. It has removed the burden of knowing the tax rates and rules, freeing me to focus more on core business activities. Further, it has made tax reporting less daunting, reducing stress during tax seasons. Overall, it’s significantly improved the efficiency and accuracy of my ability to handle taxes.

FAQs about QuickBooks Account

How do you get started with a QuickBooks Online Account?

Starting with QuickBooks Online involves creating an account on their website, selecting the appropriate subscription plan for your business, and setting up your company profile with basic details. Once set up, you can customize features like invoicing customers, connect your bank account for live transaction updates, and add users with specific access levels.

Can I access QuickBooks Online on my mobile device?

Yes, QuickBooks mobile app functionality is available for iOS and Android devices, allowing you or small business owners to manage business or personal finance on the go. From invoicing tools and expense tracking to viewing financial reports, it provides many features available on the QuickBooks desktop version.

Is QuickBooks Online suitable for small businesses?

Absolutely, QuickBooks Online is designed to cater to small businesses up to large-scale enterprises, with special features beneficial for small businesses, such as simplified invoicing, easy tracking of income and company’s average monthly expenses, and the capability to capture and organize receipts.

How secure is my data with QuickBooks Online?

QuickBooks Online prioritizes data security with robust encryption protocols, routine security audits, and dedicated servers to ensure your financial information remains confidential and protected against unauthorized access.

Can QuickBooks Online integrate with other business tools?

Yes, QuickBooks Online can integrate with various third-party apps and business tools, expanding its functionality. You can sync data with apps for payroll setup, time tracking, advanced inventory management, CRM, and more, streamlining your business processes.

Final Verdict – to Buy QuickBooks or Not to Buy QuickBooks?

After years of experience and writing this review of QuickBooks Online, my recommendation is a resounding yes!

Intuit QuickBooks Online is a robust cloud-based accounting platform that caters to the diverse needs of small to medium-sized businesses.

QuickBooks’ strength lies in its comprehensive and advanced features, including customizable invoices, creating purchase orders, access to online support from QuickBooks Certified Proadvisors, inventory management, sales tax calculations, tax deductions calculation, and reporting even for multiple companies.

Its ability to automate various financial tasks reduces errors and saves time, which allows you to focus on strategic growth. The software’s easy-to-use interface and affordability make it an excellent choice for businesses at various stages of growth.

You might have some reservations about the learning curve of using a new software. However, QuickBooks Online offers numerous resources and tutorials to help you get started and make the most of its advanced features.

In conclusion, QuickBooks Online is a versatile, user-friendly, and efficient tool for managing your business finances. It’s a worthy investment that can streamline and automate your business operations and contribute to your business’s success.

If Intuit QuickBooks Online doesn’t seem to fit your business, stay tuned! In the next section of this QuickBooks Online Review, we will explore alternatives that might better suit your needs.

QuickBooks Online Alternatives

If $18-38 is too much for you to stomach right now or you need a different solution, you might like one of these alternatives.

#1) Xero

Xero is a strong contender in the accounting software market. While QuickBooks excels in reporting and tax features, Xero stands out with its robust integration ecosystem. It is an excellent choice for large-scale to small businesses that rely on various tools for their operations.

Xero is also known for its easy-to-use interface and unlimited user allowance, unlike QuickBooks, which limits the number of users depending on your pricing plan. This makes Xero an excellent alternative for businesses that require multiple people to access their accounting software.

#2) Freshbooks

FreshBooks is another excellent alternative, particularly for freelancers, independent contractors, small business accountants, and self-employed individuals. While QuickBooks offers a comprehensive suite of advanced features that can sometimes be overwhelming for solopreneurs, FreshBooks provides a more streamlined, user-friendly experience.

Its standout features include time tracking, project management, and a client portal for easy invoicing and payment collection. FreshBooks could be the way to go for freelancers or small business owners looking for a simpler but still powerful accounting solution.

#3) Oracle Netsuite

Oracle NetSuite is a comprehensive business management suite, not just accounting software. Unlike QuickBooks, which is primarily designed for medium-sized down to small businesses, NetSuite caters to large companies and enterprises with complex needs.

It offers ERP, CRM, e-commerce features, and accounting capabilities. However, this robust functionality has a higher price tag and a steeper learning curve.

Oracle NetSuite could be your best bet if you’re a larger business or rapidly scaling startup needing more than just accounting software.

#4) Gusto

Gusto is an all-inclusive, cloud-based service designed to streamline your payroll, benefits, and HR needs. Unlike QuickBooks, Gusto takes on the responsibility of filing and remitting payroll taxes, as well as handling benefit administration.

Gusto offers a modern interface that simplifies the payroll process for business owners and employees alike. With its user-friendly platform, Gusto provides a cost-effective solution for small business owners looking for an efficient way to manage their employees’ payroll and benefits.

Overall, Gusto’s comprehensive features make it a powerful alternative to QuickBooks and other payroll management systems on the market today.