What is a Fractional CFO? Why Hire One?

Are you struggling to manage your finances effectively as you scale? Does the thought of hiring a full-time CFO seem daunting—and costly?

Imagine having the expertise of a Chief Financial Officer at your fingertips, but only when you need it. That’s where a Fractional CFO comes in—a seasoned finance executive you can tap into for strategic guidance without a full-time commitment.

A Fractional CFO is not just a financial expert but a strategic powerhouse for your scaling business. They help in forecasting, budget management, cash flow analysis, and financial strategy – ensuring that every dollar works overtime for your growth.

With their assistance, you are empowered to make informed decisions, avoid costly financial pitfalls, and drive profitability. They’re the beacon of financial insight that used to be reserved for the corporate elite, now accessible to you and your thriving business.

There is no need to wait—unlock your business’s potential for exponential growth and financial clarity. Don’t let financial complexity slow down your progress.

Seize financial control with a Fractional CFO, and watch your business soar!

What is a Fractional Chief Financial Officer (CFO)?

So, what does a fractional CFO do?

A Fractional Chief Financial Officer, or Fractional CFO for short, is a professional who offers financial expertise to businesses on a part-time or contract basis. This means you get the advantage of high-level financial guidance without bearing the cost of a full-time CFO.

Fractional CFOs typically have a wealth of experience and can bring strategic financial management to your business. They handle financial planning, risk management, record-keeping, financial reporting, and much more. This professional usually works remotely and provides services to multiple companies at once.

In essence, a Fractional CFO services agreement is a game changer for small to medium-sized businesses that need strategic financial direction but cannot afford or do not require a full-time CFO. They provide the financial help to take your business to the next level.

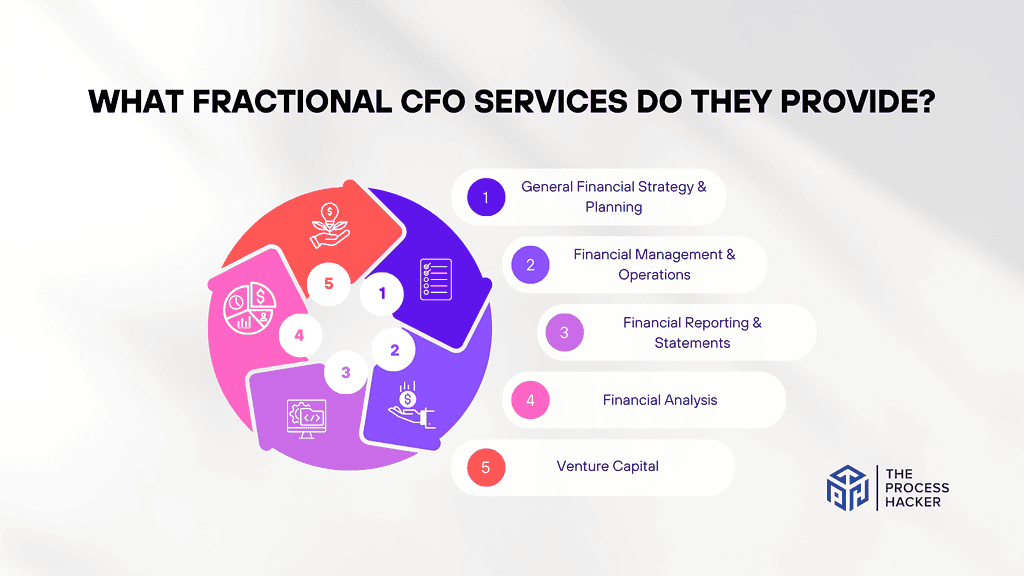

What Fractional CFO Services Do They Provide?

A fractional CFO business offers a broad spectrum of services tailored to meet your business’s unique financial needs. These services range from strategic planning to financial management and operations. Let’s delve deeper into what these services entail:

General Financial Strategy & Planning

A Fractional CFO helps you create a robust financial strategy that aligns with your business goals. They assist you in setting realistic financial targets, identifying potential challenges, and developing plans to overcome them.

This strategic guidance can help ensure the long-term financial health of your business.

Financial Management & Operations

Fractional CFOs are instrumental in managing your company’s finances. They oversee cash flow, monitor budgets, and ensure resources are efficiently used.

Their expertise in financial operations can significantly enhance your business’s financial stability and growth.

Financial Reporting & Statements

Creating and interpreting financial reports is another key service offered by Fractional CFOs. They generate financial statements such as balance sheets, income, and cash flow statements.

These reports clearly show your business’s financial position and performance.

Financial Analysis

A Fractional CFO can uncover patterns and trends in your business’s financial data through financial analysis. They can identify opportunities for growth, areas for cost reduction, and potential risks.

This invaluable insight can inform your decision-making and strategic planning.

Venture Capital

If you’re seeking venture capital, a Fractional CFO is an asset. They can help prepare your business for investor scrutiny, create compelling financial projections, and negotiate terms.

With their guidance, they can help raise capital and secure the funding you need to scale your business.

A fractional CFO’s role goes beyond just crunching numbers. They bring strategic financial guidance to the table, helping your business make informed decisions that foster growth and stability.

Whether you’re a startup seeking venture capital or an established business looking for ways to optimize your financial operations, a Fractional CFO could be the missing piece in your financial puzzle.

Their part-time nature makes their expertise accessible and affordable, making them an invaluable asset for businesses of all sizes.

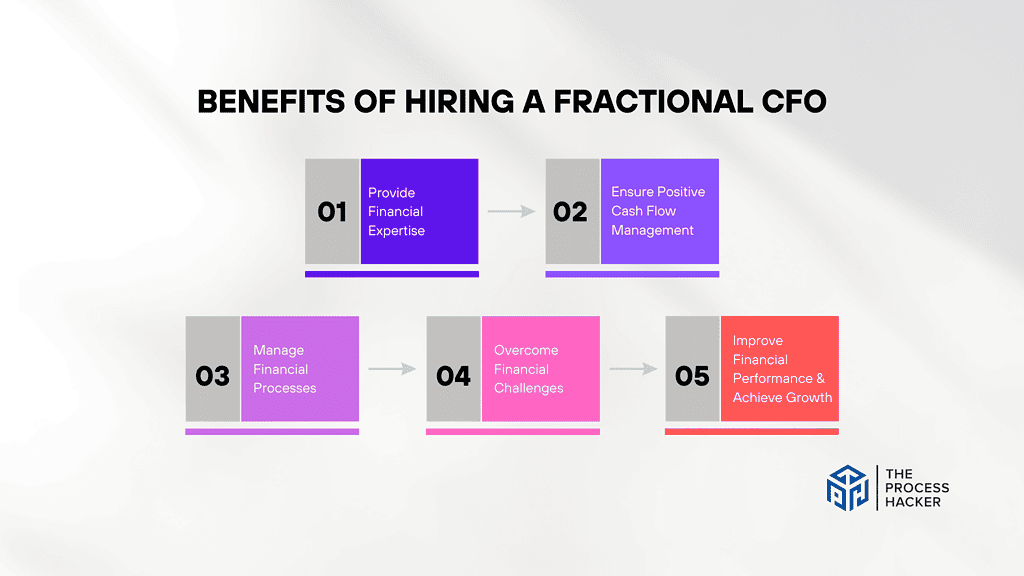

Benefits of Hiring a Fractional CFO

Hiring a Fractional CFO can significantly benefit your business, especially if you’re in the growth phase or facing complex financial challenges. Here are some key advantages you can expect when you add a Fractional CFO to your finance team:

Provide Financial Expertise

A Fractional CFO brings extensive financial expertise to your business. They understand the intricacies of financial management and can provide insights that you may not have considered.

Their experience and knowledge can be pivotal in helping your business navigate financial complexities and make informed decisions.

Ensure Positive Cash Flow Management

Managing cash flow is crucial for any business, and a Fractional CFO can help ensure it’s done effectively. They can monitor income and expenses, automate AP, automate AR, forecast future cash needs, and implement strategies to maintain positive cash flow.

This can contribute significantly to your business’s financial health and stability.

Manage Financial Processes

These financial professionals can oversee and streamline your financial processes. From budgeting and forecasting to financial reporting and analysis, they can ensure these tasks are performed accurately and efficiently.

This not only saves time but also provides you with reliable data for decision-making.

Overcome Financial Challenges

Every business faces financial challenges, and a Fractional CFO can be instrumental in overcoming them. Whether it’s improving profitability, reducing costs, or managing debt, a Fractional CFO can develop and implement strategies to address these issues.

Their problem-solving abilities can help your business thrive in challenging situations.

Improve Financial Performance & Achieve Growth

A Fractional CFO can play a key role in driving your business’s financial performance and growth. They can identify expansion opportunities, create financial models for new initiatives, and provide strategic advice to guide your growth plans.

Their input can help your business reach its full financial potential.

Hiring a Fractional CFO can bring a wealth of benefits to your business. They offer the financial expertise and strategic guidance needed to manage your finances effectively, overcome challenges, and drive growth.

Whether you’re a small business or a large corporation, a Fractional CFO can be a valuable addition to your team.

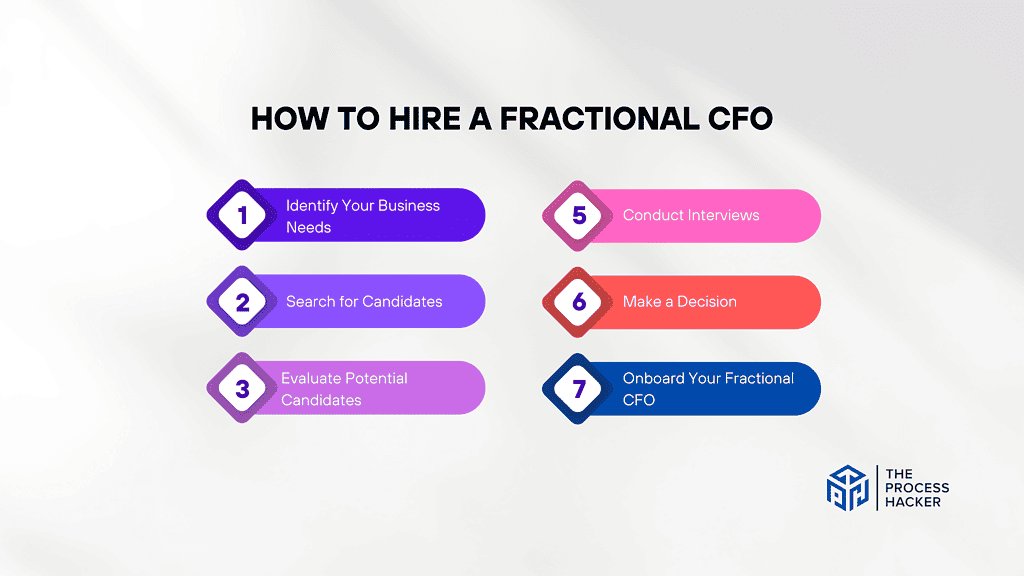

How to Hire a Fractional CFO

Hiring a Fractional CFO can be a strategic move for your business, but how do you go about it? Here’s a step-by-step guide to help you find the right fit:

Step 1: Identify Your Business Needs

Before starting your search, take time to assess your business needs. What financial challenges are you facing? What specific skills or expertise are you looking for in a Fractional CFO? Understanding your needs can help you identify the right candidate to address these issues and drive your business forward.

Step 2: Search for Candidates

Begin your search by looking at CFO service providers, consulting firms, or professional networks. Online platforms like LinkedIn can also be a great resource. Remember to look for candidates with relevant industry experience and a proven track record in similar roles. Their past performance can give you an idea of how they can contribute to your business.

Step 3: Evaluate Potential Candidates

Once you have a shortlist of potential candidates, evaluate them based on their skills, experience, and cultural fit. Consider how well they understand your industry and its specific financial challenges. Also, assess their communication skills, which will be crucial in explaining complex financial concepts to your team.

Step 4: Conduct Interviews

Interviews offer a valuable opportunity to get to know your potential fractional CFO better. Ask about their previous experiences, how they’ve tackled financial challenges, and how they can contribute to your business. This interaction can give you insights into their problem-solving abilities, strategic thinking, and interpersonal skills.

Step 5: Make a Decision

After conducting interviews, it’s time to make a decision. Consider all the information you’ve gathered, including the candidates’ qualifications, experience, and impressions from the interview. Choose the candidate who best aligns with your business needs and can bring the most value to your financial management.

Step 6: Onboard Your Fractional CFO

Once you’ve made your decision, onboard your new Fractional CFO. Introduce them to your team, explain your company’s processes and goals, and discuss their role in detail. A smooth onboarding process can set the stage for a successful working relationship.

Hiring a Fractional CFO is not a decision to be taken lightly. It’s a strategic move that can significantly improve your business’s financial health and growth. By following these steps, you can find a Fractional CFO who fits your needs and can guide your business toward financial success.

Final Thoughts on Outsourced CFO Services

A fractional CFO is not just a financial decision for your business, it is a strategic one.

By harnessing the expertise of an experienced professional without the hefty full-time price tag, you are setting your business up for success in the long run.

From providing sound financial advice to optimizing cash flow and improving profitability, a fractional CFO brings a unique perspective that can elevate your business to new heights.

So don’t wait any longer, get on a call with us today and discover why a fractional CFO is the right choice for you and your business.

Let us show you first-hand how we can help you achieve your financial goals and take your business to the next level.

Trust me when investing in a fractional CFO is genuinely an investment in the future success of your business. Take advantage of this opportunity to work smarter, not harder.

Your competitors won’t know what hit them when you have our team of expert fractional CFOs by your side.

So take action now, and let’s start building a solid financial foundation for your business together!