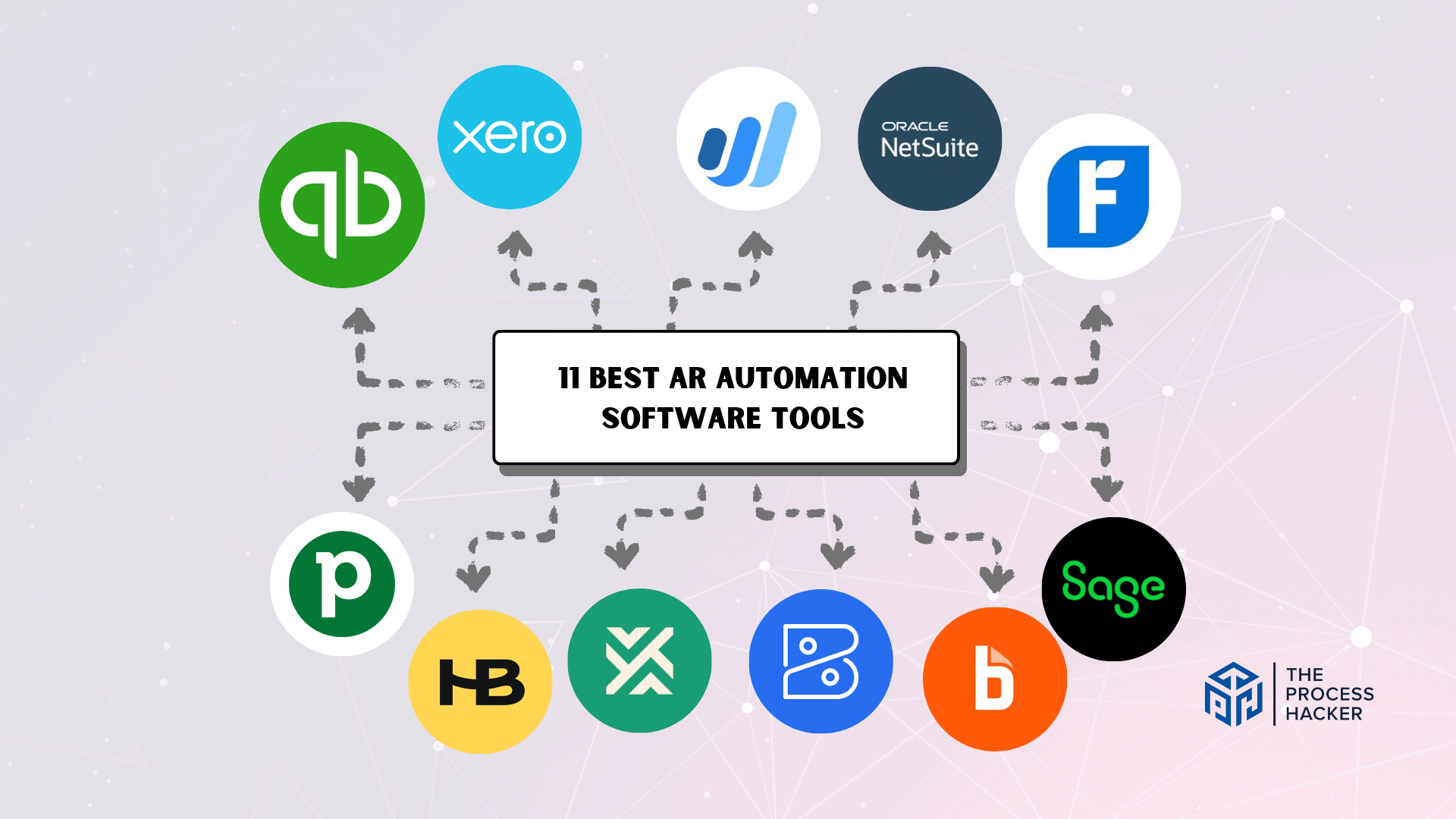

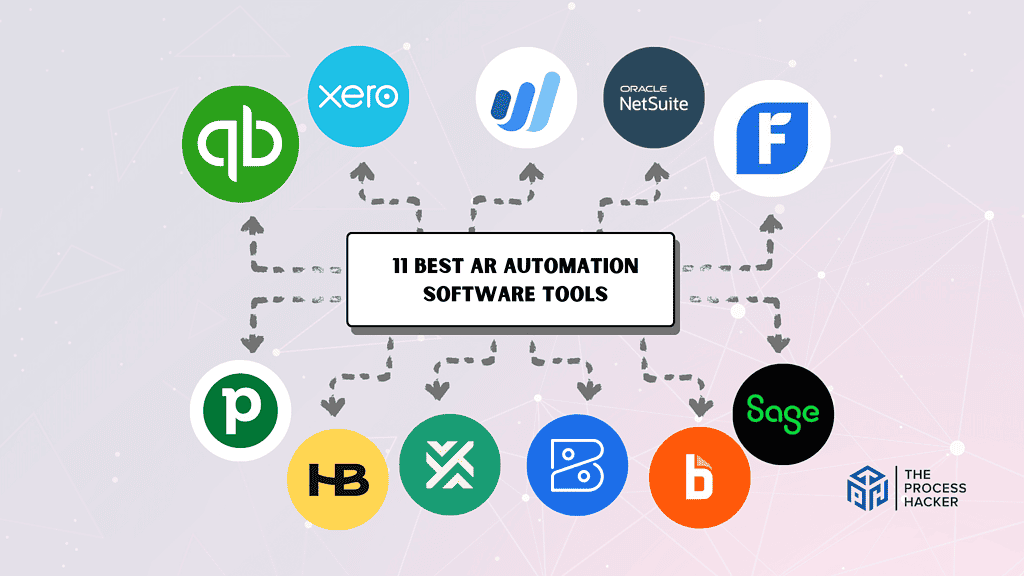

The 11 Best AR Automation Software Tools In 2024

Cash flow is critical for every company, but collecting client payments on schedule and handling accounts receivable can sometimes be difficult.

As company owners, we’ve all been scurrying to send out invoices, chase down late payments, and spend hours each week just keeping track of who owes what. But what if there was a better approach to simplifying billing and collections, allowing you to spend more time expanding your company rather than sitting behind a computer?

If you purchase through our partner links, we get paid for the referral at no additional cost to you! For more information, visit my disclosure page.

Advances in accounts receivable automation software provide entrepreneurs with significant tools to address their accounts receivable (AR) issues front-on.

These AR automation technologies assist thousands of businesses in accelerating cash flow, minimizing DSOs, and getting paid quicker by providing features such as automated invoicing, online payment portals, late fee management, collection reminders, and sophisticated reporting. This allows them to free up critical time and resources.

In this blog article, we’ll go over our top selections for the leading payments management solution, allowing you to take control of your business finances once and for all.

What Are the Best AR Automation Software Tools?

Whether you’re managing a small business or steering a large enterprise, this list has something tailored just for your accounting needs. Here are the leading AR automation software tools that stand out:

- Quickbooks Online – Best Overall Accounts Receivable Software

- FreshBooks – Best Runner-Up Accounts Receivable Software

- HoneyBook – Best Accounts Receivable Software for Freelancers & Solopreneurs

- Xero – Best Affordable Accounts Receivable Software

- Oracle Netsuite – Best Enterprise-Level Accounts Receivable Software

- Pipefy – Best Accounts Receivable Software for Other Business Processes

- Wave – Best Accounts Receivable Software for Small Businesses

- Zoho Books – Best Accounts Receivable Software for the Zoho Suite

- Bill – Best Accounts Receivable Software for Simplified Invoicing

- Sage50 Cloud – Best Accounts Receivable Software for Small Business Accounting Flow

- Invoiced – Best Accounts Receivable Software for B2B Invoicing Network

Dive deeper into each option to understand what makes them the best. The following sections will provide detailed insights to guide your choice effectively.

1) Quickbooks Online – Best Overall Accounts Receivable Software

Overview

QuickBooks Online is a popular and reliable choice for businesses seeking a comprehensive accounting solution with powerful AR automation capabilities. Streamline your invoicing process, offer convenient payment options for customers, and gain valuable insights into your accounts receivable metrics.

Key Benefits

- Easily prepares and automatically delivers professional invoices from taxes to professional fees

- Flexible payment choices include credit cards, internet payments, and ACH transfers

- Sends automatic reminders to consumers about outstanding payments gently

- Offers informative AR reporting to help you make smart financial choices

Pricing

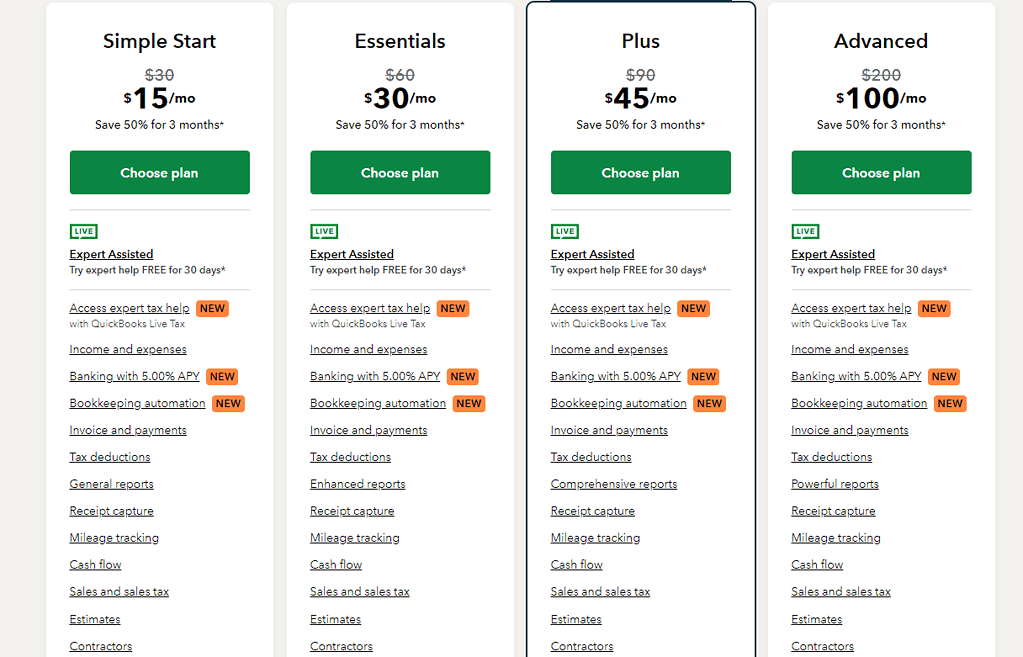

QuickBooks Online has multiple levels, beginning with the Simple Start plan for $15 per month. Pricing for the Essentials, Plus, and Advanced programs vary according on your company’s demands.

Pros & Cons

Pros

Cons

QuickBooks Online is a great option for companies of all sizes looking for integrated accounting and AR automation. However, some users may find the many functionality daunting at first.

2) FreshBooks – Best Runner-Up Accounts Receivable Software

Overview

FreshBooks is a comprehensive small company invoicing and accounting system that specializes in accounts receivable management. It is very user-friendly, making it suitable for freelancers, self-employed professionals, and small to medium-sized organizations.

Key Benefits

- Easy-to-use invoicing with speedy payment processing

- Automated expenditure tracking reduces laborious data input

- Customizable invoices improve brand consistency

- Strong reporting capabilities for financial insights and decision-making

- Mobile apps are available to manage funds on the move

Pricing

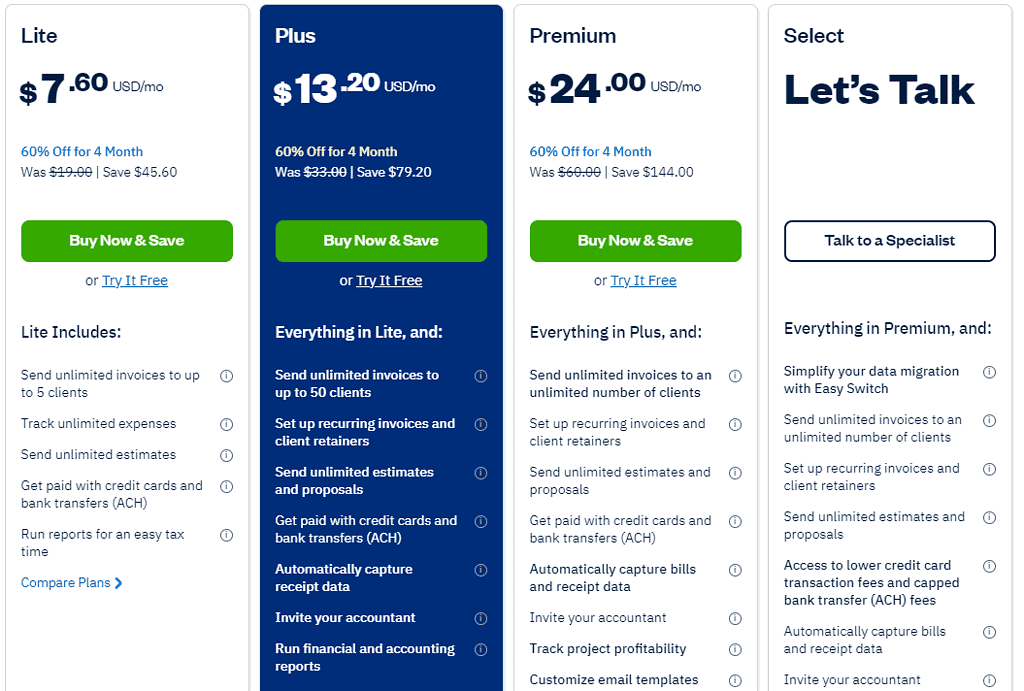

FreshBooks pricing starts at $7.60 per month on the Lite Plan, which is ideal for freelancers. Other plans include Plus for the self-employed, Premium for businesses with contractors, and a customizable plan, which caters to a wide range of business needs and sizes.

Pros & Cons

Pros

Cons

3) HoneyBook – Best Accounts Receivable Software for Freelancers & Solopreneurs

Overview

HoneyBook is one of the best all-in-one accounts receivable platforms designed to help freelancers and solopreneurs streamline client management, from proposals and contracts to invoicing and payments. Its AR automation features make getting paid easier and faster, letting you focus on your work.

Key Benefits

- An intuitive interface for managing accounts receivable procedures

- Integrated invoicing and payment systems for fast and simple transactions

- Customizable templates for creating professional invoices and contracts

- Robust reporting tools give insights into financial performance and cash flow

- Client management capabilities that assist in maintaining solid client connections

Pricing

The Starter Plan is $19 per month. HoneyBook also provides Essentials and Premium plans, which include more functionality as your company grows.

Pros & Cons

Pros

Cons

4) Xero – Best Affordable Accounts Receivable Software

Overview

Xero is a comprehensive and user-friendly accounting tool designed for small and medium-sized enterprises. Its cloud-based architecture guarantees that financial data is available at all times and from any location, giving consumers more freedom.

Key Benefits

- Automates invoice preparation and transmission and provides up-to-date financial information to help firms make educated choices fast.

- Ensures that financial information is available from any device.

- Allows firms to trade in several currencies, which is critical for worldwide operations.

- Easily connects with several third-party applications and services.

Pricing

Xero’s Early Plan begins at $3.75 a month and is designed for small enterprises or individuals who need basic AR functions. For organizations looking for more sophisticated capabilities, Xero’s Growing and Established Plans provide multi-currency support and extensive analytics, assuring scalability as company requirements change.

Pros & Cons

Pros

Cons

5) Oracle Netsuite – Best Enterprise-Level Accounts Receivable Software

Overview

Oracle NetSuite is a sophisticated Enterprise Resource Planning (ERP) application designed for diverse corporate demands. Its AR automation technologies provide powerful capabilities for handling invoicing, payments, and collections inside a wider company management system.

Key Benefits

- Adapts to the special needs of major organizations

- Provides detailed information regarding AR performance

- Manages multi-currency transactions and multinational operations

- Provides a smooth workflow spanning finance, inventory management, and more

- Contains payment reconciliations, collection management, and more

Pricing

Oracle NetSuite price is customizable, and obtaining a quotation involves contacting their sales staff. Expect a basic price of about $99 per user each month, plus a $999 monthly license charge, however your actual expenditures may be greater or lower depending on your company’s requirements.

Pros & Cons

Pros

Cons

6) Pipefy – Best Accounts Receivable Software for Other Business Processes

Overview

Pipefy Finance is an intuitive, flexible process management tool that extends its capabilities to accounts receivable. It enables businesses to streamline their financial operations alongside other core business processes.

Pipefy’s user-centric design and customization options make it adaptable for various industries, enhancing workflow automation and data management.

Key Benefits

- Streamlined process management integrates AR with other business operations

- Customizable business workflows to align with specific business needs

- Advanced reporting and analytics for better financial oversight

- Automation of repetitive tasks to increase efficiency

- User-friendly interface that requires minimal training

Pricing

Pipefy’s Business Plan, built for small and medium-sized businesses, starts at $24 per user each month. Pipefy provides Enterprise and Unlimited Plans to bigger enterprises that need sophisticated capabilities such as enterprise-level security and management.

Pros & Cons

Pros

Cons

7) Wave – Best Accounts Receivable Software for Small Businesses

Overview

Wave is one of the best and most popular accounts receivable software for small companies, providing a comprehensive, user-friendly platform at an amazing price. It automates invoicing and payment monitoring, allowing company owners to concentrate on core operations rather than human accounting.

Key Benefits

- Free invoicing and accounting services ideal for small enterprises

- Simple connectivity with bank accounts and payment processes

- Customizable invoice templates that match your business’s branding

- Easily monitor expenses by scanning receipts

- Real-time financial reporting to keep track of your business’s finances

Pricing

Wave’s price structure is really straightforward. It provides a free Starter plan, which includes basic invoicing and accounting functions. The Pro Plan is $16 per month for enterprises that want more sophisticated capabilities.

Pros & Cons

Pros

Cons

8) Zoho Books – Best Accounts Receivable Software for the Zoho Suite

Overview

Zoho Books is a cloud-based accounting system that includes sophisticated AR features. It’s perfect for organizations who have already invested in the Zoho ecosystem, since it offers seamless connectivity and familiar navigation.

Key Benefits

- Seamless integration with the Zoho ecosystem, enhancing productivity

- Automated payment reminders to expedite receivables collection

- Customizable invoice templates to reflect brand identity

- In-depth financial reports for better decision-making

- Multi-currency handling to support global business transactions

Pricing

Zoho Books’ price begins at $12 per organization each month. They provide Professional, Premium, Elite, and Ultimate plans that provide additional capabilities for larger enterprises.

Pros & Cons

Pros

Cons

9) Bill – Best Accounts Receivable Software for Simplified Invoicing

Overview

Bill.com is a cloud-based financial software that streamlines both the accounts receivable (AR) and payment (AP) processes. Its emphasis on user-friendly invoice preparation and payment collection makes it a good choice for companies looking for a simple AR solution.

Key Benefits

- Easy-to-create, professional invoices

- Automated invoice sending and reminders

- Multiple payment options for customers (ACH, credit card)

- Syncs with popular accounting software

- Offers both AR and AP solutions for streamlined workflows

Pricing

Bill.com’s Accounts Receivable price is divided into two tiers: $45 per user per month for the Essentials plan and $55 for the Team plan.

Pros & Cons

Pros

Cons

10) Sage50 Cloud – Best Accounts Receivable Software for Small Business Accounting Flow

Overview

Sage50 Cloud is a strong accounting software designed for small companies that includes extensive accounts receivable capabilities and complete financial management tools. Sage company Cloud Accounting combines the benefits of the cloud with the depth of desktop accounting software, allowing for seamless integration of company operations and financial monitoring.

Key Benefits

- An intuitive interface that simplifies financial management for small enterprises

- Streamline accounts receivable with robust invoicing and payment monitoring

- Secure cloud access allows financial monitoring from anywhere

- Detailed financial reporting to make informed business choices

- Integration with other corporate software for a comprehensive strategy

Pricing

Sage 50cloud pricing begins at $58.92 per user per month, with additional levels such as Premium Accounting and Quantum Accounting available to give a comprehensive Sage 50 experience according to the requirements of the organization.

Pros & Cons

Pros

Cons

11) Invoiced – Best Accounts Receivable Software for B2B Invoicing Network

Overview

Invoiced is an AR automation tool developed exclusively for B2B companies. It provides tools for handling complicated B2B invoicing situations, such as payment plans, subscriptions, and a large invoicing network for expedited transactions.

Key Benefits

- Strong B2B-specific invoicing and payment capabilities

- Automate payment reminders and collecting processes

- Access the Invoiced Network for speedier B2B payments

- Advanced reporting and analytics for augmented reality

- Integrates with common accounting and CRM systems

Pricing

Invoiced does not have defined price levels, but instead provides personalized plans beginning at $400 per month, with yearly savings available. Contact its sales staff for a quotation personalized to your needs.

Pros & Cons

Pros

Cons

What Are Accounts Receivable Software Tools?

Accounts receivable (AR) automation software streamlines and automates business and client invoicing, payment collection, and balance management. These automation solutions help firms get paid quicker, decrease mistakes, and enhance cash flow.

Aside from the main functionalities listed above, many AR automation technologies include additional advantages that may have a big influence on your organization. This includes:

- Client Portals: Offer customers a safe online place to see invoices, make payments, and manage account information, therefore enhancing the customer experience and lowering administrative expenses.

- Dispute Resolution Tools: Provide built-in options for managing and resolving payment issues, which streamlines communication and keeps the AR process running smoothly.

- Advanced Analytics: Powerful reporting dashboards provide greater insights into your AR performance, allowing you to spot bottlenecks, estimate cash flow, and make data-driven choices.

When selecting AR automation software, keep in mind the main invoicing and payment functions, as well as the extra capabilities, which may have a big influence on your total AR efficiency and client experience.

How Can AR Automation Software Tools Benefit You?

Accounts receivable management software has several advantages that may significantly improve your accounts receivable procedures. Here’s how.

- Improved Cash Flow: With automatic invoicing, payment reminders, and improved collections, you’ll get paid quicker and more regularly. This improved cash flow drives corporate development and improves financial stability.

- Enhanced Accuracy: Reduce human error in invoicing and computations to avoid expensive errors and conflicts. This greater accuracy enhances your financial records while also increasing client confidence.

- Increased Productivity: Free your staff from time-consuming manual duties, enabling them to concentrate on more strategic work. This increased productivity may save you time, money, and even allow you to grow your firm without adding too much overhead.

Beyond these obvious advantages, AR automation software may improve your customer connections. Features like automatic reminders given in a polite tone and handy online payment alternatives make life easier for your customers, increasing customer satisfaction and loyalty.

Buyers Guide: How We Conducted Our Research

To find the finest accounts receivable software companies out there, we conducted a thorough review process that took into consideration a wide range of variables important to businesses looking for effective and dependable accounts receivable solutions.

Initially, we did a thorough market study to identify a varied variety of software tools, followed by an in-depth review of their features, price, and user feedback from numerous platforms. This technique allowed us to evaluate each tool’s value proposition, concentrating on essential features like automatic invoicing, payment tracking, and connectivity with other company systems.

Furthermore, we paid close attention to user feedback and personal experiences to better grasp the practical ramifications of utilizing each software product in real-world circumstances. This was supplemented by a review of the existing support mechanisms, such as customer service responsiveness and community participation, as well as each tool’s dedication to security, compliance, and innovation.

By compiling this data, we hoped to create a thorough and balanced guide that highlighted the strengths and possible limits of the best AR automation solutions today, responding to the diverse demands of organizations across sectors.

Final Thoughts on AR Automation Software

Investing in any of the best accounts receivable software mentioned above is a wise decision for you and your company, particularly if you want to simplify your invoicing and payment procedures.

AR automation software helps you save time, decrease mistakes, increase cash flow, and improve client connections.

When selecting the proper accounts receivable software, take into consideration your company’s features, cost, and special requirements. The alternatives presented in this book are an excellent beginning point, giving a wide range of solutions to suit a variety of enterprises.

By using the tools and insights, you’ll be well-prepared to discover the ideal AR automation platform to improve your financial operations.

Frequently Asked Questions (FAQs)

Can AR automation software integrate with my existing accounting system?

Many popular AR automation tools offer integrations with common accounting software, such as QuickBooks, Xero, and others. To ensure a seamless workflow, make sure to check the compatibility of your chosen software with your existing systems.

What are the key features to look for in AR automation software?

Core features typically include automated invoicing, payment reminders, online payment processing, reporting, and customer portals. Consider your specific business needs to determine which additional features (like advanced analytics or dispute resolution tools) would be most beneficial.

How secure is AR automation software?

Reputable AR automation providers prioritize data security using encryption, secure servers, and regular security audits. Look for certifications like SOC 2 compliance, which indicates adherence to strict data security standards.

Is AR automation software challenging to implement?

Most modern AR automation software solutions are designed with user-friendliness in mind. Many providers offer guided setup, onboarding resources, and ongoing support to ease the implementation process.

Can AR automation software help me handle international clients and currencies?

Some enterprise-level AR solutions offer multi-currency support and features suitable for international transactions. Be sure to inquire about specific capabilities if you frequently invoice clients in different countries.

Are there free accounts receivable software?

Absolutely! Several accounts receivables software options offer free plans or trials, providing businesses with basic AR automation features. However, free plans generally have limited features or user capacity compared to paid options.