Finance Automation: A Comprehensive Guide for 2024

As an entrepreneur, you know that managing finances can be a daunting task.

From tracking expenses, processing invoices, and creating budgets and forecasts – there never seems to be enough time in the day.

However, this all changes with advancements in technology and the rise of finance automation tools. In this comprehensive guide, we will dive into the world of finance automation: what it is, how it works, and, most importantly, how it can benefit your business in the years to come.

Get ready to say goodbye to tedious financial tasks and hello to increased efficiency and accuracy in your financial management process. Let’s explore what lies ahead for finance automation and how it will revolutionize how businesses handle their finances.

Bottom Line Up Front (BLUF) Summary

- Unlock the potential of finance automation in 2023 by embracing RPA, AI, and automating key processes.

- Navigate resistance to change & ensure compliance/security for successful implementation.

- Achieve ROI with increased productivity, fewer errors, and informed decision-making.

What is Finance Automation?

Imagine a finance department without manual data entry, tedious workflows, and human errors. That’s the power of finance automation technology.

By eliminating manual tasks, finance automation can transform your financial processes, allowing finance professionals to focus on complex financial analysis and strategic initiatives. The benefits of finance automation streamline finance functions and improve overall efficiency, empowering finance leaders to make sound business decisions.

Finance automation leverages two key technologies: Robotic Process Automation (RPA) and Artificial Intelligence (AI). In the following sections, we’ll explore how these technologies integrate into your finance operations, creating a seamless and efficient financial ecosystem.

The Rise of Robotic Process Automation

Robotic Process Automation (RPA) is revolutionizing the finance industry by automating repetitive tasks and freeing up human resources for higher-value work. With an estimated market size of $2.9 billion by the end of 2021, RPA has become essential to financial process automation. By automating manual tasks and minimizing human intervention, RPA can significantly improve operational efficiency in finance operations.

RPA tools are designed to handle a wide range of tasks, from invoice processing to journal entries. Moreover, RPA can work with Business Process Automation (BPA) to create a complete digital transformation that enhances finance operations for employees, vendors, and customers.

With streamlined workflows and reduced errors, RPA is an indispensable asset to finance teams looking to embrace the future of automation.

Integrating Artificial Intelligence (AI)

Artificial Intelligence (AI) takes finance automation to the next level by enabling data-driven decision-making and predictive analytics. Machine learning, a subset of AI, leverages historical data to identify patterns and make decisions without human intervention. Finance teams can utilize machine learning algorithms for scenario testing and precise financial analysis, preparing for potential unfavorable situations.

Integrating AI and machine learning into finance automation technology offers several benefits.

- Boosts efficiency

- Empowers finance professionals to make well-informed future choices based on data-driven insights

- Shapes the future of finance automation

- Enables teams to adapt and excel in their financial processes

As businesses continue to evolve, AI will play a crucial role in shaping the future of finance automation.

Why Should You Implement Automation In Your Finance Department

Empowering your finance team with automation will increase productivity and efficiency, reduce errors, improve accuracy, and enhance decision-making and insights. It will also let your finance team focus on strategic initiatives and make more informed decisions.

Boosting Productivity and Efficiency

One of the primary benefits of finance automation is its boost in productivity and efficiency. By eliminating manual tasks and automating repetitive processes, finance teams can save time and focus on strategic initiatives and value-added activities.

Streamlining accounts payable and receivable, improving payroll management, and optimizing financial planning and analysis are just a few examples of key finance processes that can be automated to save time and increase efficiency. With the right automation tools in place, your finance team can work smarter, not harder, driving growth and success for your organization.

Reducing Errors and Improving Accuracy

Finance automation can significantly reduce errors and improve accuracy in financial processes by eliminating manual data entry and streamlining workflows. With accurate and consistent financial data, your finance team can make sound business decisions and ensure the reliability of financial reports.

By automating tasks such as invoice capture, coding, approval, and payment, finance teams can ensure the accuracy and timeliness of financial processes. In addition, finance automation tools can help detect and prevent duplicate entries, further reducing errors and improving the accuracy of financial data.

Enhancing Decision-Making and Insights

Finance automation is crucial in enhancing decision-making and providing insights for finance teams. By offering real-time data access and enabling the identification of trends, finance automation tools empower teams to make more informed decisions.

Utilizing automation tools for financial planning and analysis allows finance professionals to access real-time data, improve forecasting capabilities, and make more informed and data-driven decisions. In a rapidly changing financial landscape, having access to accurate and up-to-date information is essential for making sound business decisions and driving growth and success for your organization.

What are the Key Finance Processes to Automate?

Now that we’ve explored the technologies behind finance automation let’s identify the key finance processes that can benefit the most from automation. By assessing your current setup and automating tasks that don’t require much human involvement, you can unlock the true potential of finance automation. Some key areas to consider include accounts payable and receivable, payroll management, and financial planning and analysis.

Automating these processes can streamline finance operations, improve accuracy, and enhance operational efficiency. In the following sections, we’ll discuss how automation can be applied to these specific areas and the benefits it can provide to your finance department.

Streamlining Accounts Payable and Receivable

Automating accounts payable and receivable processes can significantly reduce errors, improve cash flow management, and enhance supplier and customer relationships. For instance, accounts payable automation can help your business save money with early payments and discounts, free up staffing resources, and strengthen supplier relationships.

On the other hand, automating accounts receivable processes can reduce mistakes, streamline cash flow management, and strengthen supplier and customer relationships. By automating invoice capture, coding, approval, and payment, finance teams can ensure accuracy and timeliness in managing company expenses.

Enhancing Payroll Management

Enhancing payroll management through automation ensures accurate calculations, timely payments, and improved employee satisfaction. By automating tasks such as salary calculations, benefits management, and tax deductions, your finance team can make payroll management a breeze.

Software solutions like BambooHR, PayFit, and Personio can streamline payroll processes, ensuring compliance and reducing the risk of errors. By automating payroll management, your finance team can focus on strategic initiatives and value-added activities, ultimately boosting your organization’s productivity and efficiency.

Optimizing Financial Planning and Analysis

Optimizing financial planning and analysis with automation tools enables real-time data access, better forecasting, and more informed decision-making. Finance automation can help teams analyze financial data, spot trends, find opportunities, and streamline budgeting and forecasting processes.

With real-time access to data and improved forecasting capabilities, finance professionals can make more accurate and informed decisions, driving growth and success for the organization. In a world of ever-changing financial landscapes, automation in financial planning and analysis equips finance teams with the tools they need to stay ahead and ensure the long-term success of their organization.

How to Implement Financial Automation

Implementing finance automation solutions involves a three-step process: assessing your current setup, choosing the right software, and ensuring seamless integration with existing systems. This process lets you identify areas where automation can provide the most significant benefits and select the right tools to fit your needs.

#1) Assessing Your Current Setup

First, you need to assess your current financial processes and identify areas where automation will provide the most significant benefit. By examining your existing workflows and pinpointing tasks that are repetitive and prone to errors, you can create a roadmap for introducing automation and transforming your finance operations.

Automation can streamline manual processes, reduce errors, and improve accuracy. It can also be helpful.

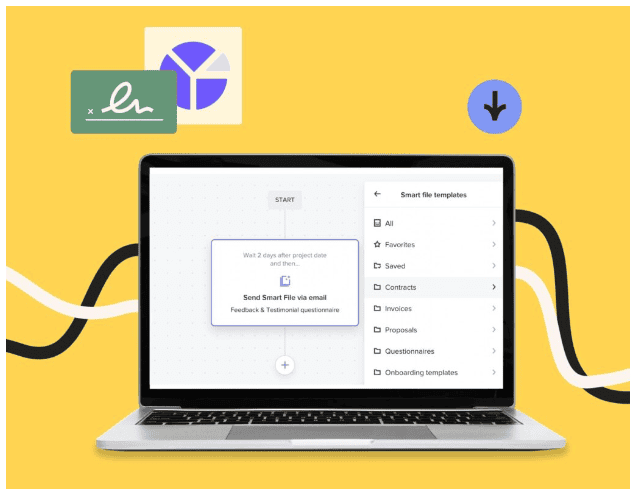

#2) Choosing the Right Automation Software

Choosing the right automation software is a crucial step in the implementation process. Factors to consider while evaluating options include cost, ease of use, scalability, security, integration with existing systems, and support and maintenance.

By comparing the features of different solutions and selecting one that aligns with your business needs, you can ensure a successful implementation and maximize the benefits of finance automation.

When evaluating automation software, it’s essential to conduct thorough research, consult with industry experts, and consider user reviews to make an informed decision. By carefully selecting the right software, you can seamlessly integrate your existing processes and systems, maximizing efficiency and minimizing disruption.

#3) Ensuring Smooth Integration

Seamless integration of automation tools with your current processes and systems is vital for maximizing efficiency and minimizing disruption. To achieve this, it’s important to:

- Involve all relevant stakeholders in the implementation process

- Provide training and support

- Establish robust controls to ensure compliance and security.

By taking these steps, you can ensure a smooth transition to finance automation and unlock its full potential for your organization.

What Are the Best Finance Automation Tools?

Here are some recommended finance automation tools

QuickBooks

QuickBooks stands out as a stalwart in the finance automation arena, offering robust features that cater to the diverse needs of small to medium-sized businesses.

It simplifies accounting tasks like payroll, invoicing, taxes, and expense tracking, ensuring accuracy and saving time. The platform’s intuitive design makes financial management accessible, even for those without a background in accounting.

With real-time dashboard insights, you’re always informed about your business’s financial health, enabling informed decision-making. Integration capabilities with banks and other apps enhance its utility, making QuickBooks versatile in your financial toolkit.

QuickBooks Online is a great option for companies of all sizes looking for integrated accounting, AP automation, and AR automation. However, some users may find the many functionality daunting at first.

Xero

Xero revolutionizes how businesses manage their finances, championing cloud-based solutions that offer flexibility and efficiency.

Aimed at small to medium enterprises, Xero provides a comprehensive suite of tools for managing invoices, assets, and expenses, all from anywhere, at any time. Its user-friendly interface demystifies financial management, making it approachable for non-accountants.

Collaborative features allow seamless interaction with your accountant or team, fostering transparency and streamlined workflows. Xero’s commitment to innovation is evident in its continuous updates, ensuring your financial operations are always at the cutting edge.

Gusto

Gusto is redefining payroll, benefits, and HR for the modern workplace. It is designed with simplicity and usability and automates complex processes to ensure compliance and accuracy.

Gusto is an all-in-one platform that manages payroll effortlessly and handles taxes, time tracking, and benefits administration. Its employee-centric features include onboarding, time-off requests, and online access to pay stubs and W-2s.

Gusto’s proactive approach to customer service and its scalable solutions make it an excellent choice for businesses looking to grow without being bogged down by administrative tasks.

Overcoming Challenges in Finance Automation

Implementing finance automation solutions is not without its challenges. Some common obstacles include resistance to change, compliance issues, security concerns, and achieving ROI and scalability.

Navigating Resistance to Change

Resistance to change is a common challenge, so it’s important to communicate clearly with employees and clients. You should explain the benefits of automation and address any concerns they may have.

Then, you can provide training and support to help employees adapt to new processes and tools so they are not afraid of losing their jobs or interest in the work. Additionally, involving employees in decision-making and seeking feedback can help alleviate fears or resistance.

Addressing Security Concerns

Sensitive financial data is processed through automated systems, so it’s crucial to implement robust security measures such as encryption, access controls, and regularly updating software.

Demonstrating the benefits of automation to stakeholders can build trust and support for the change. By addressing resistance to change proactively and ensuring that all parties understand the value of finance automation, you can create a positive environment for change and drive successful implementation.

Ensuring Compliance and Security

Compliance and security are critical concerns when implementing finance automation. To ensure compliance and security, follow these essential steps:

- Select reliable software.

- Implement robust controls.

- Regularly monitor processes.

- Involve stakeholders in the implementation process.

- Provide training to create a culture of compliance.

By following these steps, you can ensure that all employees understand the importance of adhering to regulations and maintaining security.

Using accounting software with built-in compliance features, such as Taxify, can help businesses manage tax obligations across international jurisdictions and stay audit-ready. By ensuring compliance and security, you can mitigate risks and create a solid foundation for successful finance automation implementation.

Achieving ROI and Scalability

Achieving ROI and scalability with finance automation requires careful planning, selecting the right tools, and continuously monitoring and adjusting processes as needed. By focusing on areas where automation can have the most significant impact and ensuring that the chosen solution meets your organization’s needs, you can maximize your return on investment and ensure long-term success.

A strategic and holistic approach to finance automation can help organizations create a robust business case, ensuring that the selected solution is tailored to their specific needs and maximizes the return on investment. By continuously monitoring processes and adjusting them as needed, you can ensure that your finance automation strategy remains agile and adaptable, driving growth and success for your organization.

Final Thoughts on Finance Automation

In conclusion, finance automation is the future of efficient and accurate financial management. From automating tasks like data entry and reconciliation to providing real-time insights and analysis, finance automation has revolutionized how businesses handle their finances.

By implementing finance automation in your business, you can streamline processes, save time, eliminate errors, and improve overall financial performance. It may seem daunting initially, but with the right technology partner and proper implementation plan, finance automation can seamlessly integrate into your business operations and bring significant benefits.

Don’t wait any longer—take advantage of this game-changing technology today!

With finance automation on your side, you can focus on growing your business while leaving repetitive and manual tasks to AI-powered systems. So why not make the smart move?

Implement finance automation in your business now and witness the difference it can make! Trust me; you won’t regret it.

FAQs on Finance Automation

What is finance automation?

Financial automation involves using software and technology to streamline traditionally manual tasks such as account reconciliation, journal entries, financial statements, and budgeting.

These tasks can be automated to save time and money and reduce the risk of errors. Automation can also help improve accuracy and consistency in financial reporting.

By automating these processes, businesses can reduce costs.

What are the benefits of finance automation?

Finance automation minimizes errors and data loss, increases collaboration, and boosts overall productivity, allowing finance teams to work smarter and more efficiently.

By automating mundane tasks, finance teams can focus on more strategic initiatives and drive greater organizational value. This can improve customer service, improve decision-making, and increase profitability.

Will the finance industry be automated?

Automation in the finance industry is already well underway and will continue to grow. Many companies are looking to further increase their automation adoption to make more routine tasks automated.

This is an excellent opportunity for businesses to save time and money, as well as increase efficiency. Automation can streamline processes, reduce errors, and improve customer service.

What are the key technologies behind finance automation?

Robotic Process Automation (RPA) and Artificial Intelligence (AI), including machine learning, are the key technologies driving finance automation today.

How can finance automation enhance decision-making and insights?

Finance automation provides real-time data access and can identify trends, allowing finance teams to make better decisions and gain valuable insights.