How to Value a Small Business: A Comprehensive Guide for Entrepreneurs

Ever wondered what your business is really worth? Or maybe you’re eyeing an acquisition and need a fair price?

Valuing a small business is a complex puzzle, but it’s crucial to solve. Whether planning for the future, seeking investment, or considering a sale, understanding your business’s value is the cornerstone of smart decision-making.

In this guide, we’ll discuss the ins and outs of business valuation, specifically tailored to today’s entrepreneurial landscape. We’ll explore the key methods professionals use, the factors influencing value, and the common pitfalls to avoid.

By the end, you will have the knowledge to confidently navigate the valuation process and unlock your business’s true worth.

What is Small Business Valuation?

Small business valuation is the systematic process used to determine what a business is worth. This assessment can vary greatly depending on several factors, including the purpose of the valuation, the business’s financial health, and its future earning potential.

In today’s fiercely competitive environment, having a precise valuation is indispensable. It allows you to position your business advantageously in the market, whether you are negotiating a sale, seeking funding, or evaluating growth opportunities. An accurate valuation ensures that you are making informed decisions backed by data that reflects the true worth of your business.

Key Components: Assets, Cash Flow, Market Conditions

- Assets: Everything you own has value. This includes tangible assets like property, equipment, and inventory and intangible assets such as patents, trademarks, and customer relationships.

- Cash Flow: Your business’s future cash flow is a powerful indicator of its health. Valuation often hinges on the ability to generate stable and predictable cash flows adjusted for the time value of money.

- Market Conditions: External factors like industry trends, economic climate, and competition play a significant role in your business valuation. Understanding how these elements affect your business can provide insight into its potential market value.

By grasping these foundational elements, you are better equipped to navigate the complexities of small business valuation.

Why You Should Know How to Value Your Small Business

Having a firm grasp of your business’s value isn’t just about numbers on a page. It’s about gaining a strategic advantage, making smarter choices, and positioning yourself for success. Here’s why understanding your business’s worth is so crucial:

- Informed Decision-Making: Whether you’re considering expanding, bringing on new partners, or seeking funding, knowing your business’s value helps you confidently weigh your options.

- Attracting Potential Buyers or Investors: When the time comes to sell or seek investment, a solid valuation demonstrates the strength of your business and attracts serious buyers or investors.

- Financial Planning and Growth Strategies: Understanding your monetary value helps you set realistic financial goals, develop growth strategies, and ensure the sustainability of your business.

Here are some additional benefits of valuing your small business:

- Negotiate better deals with investors. When you know your business’s value, you can negotiate from a position of strength.

- Understand your business’s strengths and weaknesses. A valuation process often reveals areas where your business excels and where there’s room for improvement.

- Plan for future exit strategies. Whether planning for retirement or considering a sale, knowing your value lets you strategize for the future.

- Secure loans with accurate business-worth information. Banks and lenders rely on valuations to assess your creditworthiness and loan eligibility.

How to Value a Small Business: A Step-by-Step Guide

Valuing your small business accurately is more than a mere calculation; it’s a critical analysis that affects almost every aspect of your business strategy. In this step-by-step guide, you’ll learn the structured approach to determining your business’s worth, providing a solid foundation for making key business decisions, securing investments, or preparing for a sale.

Step 1: Gather Your Financial Statements

Accurate financial records are the foundation of any valuation. Think of them as the blueprints to your business’s financial health.

- Collect income statements: These show your revenue, expenses, and net income over a specific period, usually a year. They reveal how profitable your business is.

- Prepare balance sheets: These provide a snapshot of your business’s assets, liabilities, and equity at a given point in time. They showcase your financial standing.

- Compile discounted cash flow analysis: These track the flow of cash in and out of your business. They offer insights into how you’re generating and using cash.

Step 2: Calculate Your Business Assets

The next crucial step in valuing your small business involves a thorough assessment of both your tangible and intangible assets. This step is essential to ensure you capture the full spectrum of your business’s assets and their value on the market.

List all physical assets, such as equipment, inventory, real estate, and vehicles. These are easier to value because they have a clear market worth, which current resale values, depreciation schedules, and replacement costs can determine.

Intangible assets, which are less tangible than physical assets, can often carry significant value. These include brand recognition, patents, trademarks, and customer relationships. Valuing these requires understanding the economic benefits they bring to your business, such as market position and potential for future earnings.

Combine the values of both tangible and intangible assets to establish your business’s overall asset value. Fair market and business value should reflect what a willing buyer would pay under current market conditions, so consider getting professional appraisals, especially for high-value or unique assets.

Step 3: Analyze Your Cash Flow

A thorough analysis of your cash flow is vital for understanding your business’s liquidity and long-term viability. This step focuses on assessing the money that flows in and out of your business, which can help determine its capacity to generate future earnings.

Calculating Seller Discretionary Earnings (SDE) is crucial for small businesses, as it represents the true economic benefit to the business owner. It starts with net profit and adds back expenses unique to the current ownership, such as personal expenses, one-time costs, and discretionary spending. This figure provides a more accurate representation of the business’s potential profitability under new ownership.

This method involves projecting your business’s future cash flows and then discounting them to their present value. This approach is beneficial for understanding your business’s value over the long term, as it considers the time value of money. Factors such as inflation, risk, and future cash flow uncertainty are incorporated to determine how much future cash flows are worth today.

Estimate the expected pattern of cash flows based on historical data, current market trends, and predicted future developments. This projection should account for typical operations and potential changes in the business environment, such as new product launches or market expansions.

Step 4: Apply Business Valuation Methods

Now comes the heart of the process: using an established and comprehensive business valuation tool to calculate your business’s worth. Consider these methods as different lenses through which to view your company’s value. Each has strengths and weaknesses; the best approach often involves combining multiple methods.

Market Value Approach

This involves comparing your business to similar ones that have recently been sold.

- Research comparable businesses: Look for companies in your industry with similar size, revenue, and profitability that have recently been sold.

- Analyze recent sales: Compare the sale prices of these businesses to your own, making adjustments for any differences in size, location, or other factors.

Asset-Based Approach

This focuses on the value of your business’s net assets.

- Calculate adjusted net asset value: Start with your balance sheet and adjust the value of your assets and liabilities to their fair market value.

- Consider liquidation value: This represents the amount you could get if you sold all your assets and paid off all your debts. It’s generally considered a floor for your business’s value.

Income-Based Approach

This estimates your business’s value based on its future earning potential.

- Use the discounted cash flow method: This involves forecasting your future cash flows and discounting them back to their present value.

- Apply earnings multiples: This involves multiplying your earnings by an industry-specific multiple.

Step 5: Consider Intangible Factors

Numbers tell part of the story but not the whole picture. Your business’s value extends beyond its financial statements. Let’s factor in the less tangible elements that contribute to your company’s worth.

- Evaluate your customer base: Loyal, repeat customers are a goldmine. Assess the size, stability, and growth potential of your customer base.

- Assess brand reputation and recognition: A strong brand commands a premium. Consider the strength of your brand, its recognition in the market, and the positive associations it evokes.

- Consider market position and growth potential: Are you a leader in your industry or a rising star with significant growth potential? Your market position and future prospects can significantly impact your valuation.

Key Considerations for Successfully Valuing a Small Business

Properly valuing a small business is critical, not just when preparing to sell but also for establishing a clear understanding of the business’s growth trajectory and market standing. Here are several key considerations to ensure a thorough and accurate valuation.

Understanding Industry-Specific Factors

Stay updated on the latest developments in your industry, including regulatory changes and technological advancements. Benchmarks such as average profit margins and revenue growth rates provide a comparative standard.

Economic shifts can significantly impact your business’s value. Factors like changes in consumer spending, interest rates, and inflation should be considered.

Understand your business’s competitive position. Analyzing how your competitors are performing and how much market share you control can reveal strengths and weaknesses that affect valuation.

The Role of Professional Valuation Services

Professional valuators bring expertise and impartiality, offering a detailed, accurate valuation based on current market and financial data.

Consider hiring a professional during major business milestones such as acquiring funding, considering a sale, or planning succession.

Weigh the cost of hiring a professional against the potential risks of an inaccurate self-evaluation. The benefits of expert advice and precise valuation often outweigh the costs.

Common Pitfalls in Small Business Valuation

Small business owners often value their business based on personal sweat equity rather than objective metrics. It’s vital to separate personal feelings from factual data.

Adjust financial statements to remove anomalies or non-recurring expenses to reflect the business’s sustainable earnings better.

Economic and industry-specific trends can significantly impact your business’s current and future value. Neglecting these can lead to unrealistic valuations.

Taking it to the Next Level: Advanced Valuation Techniques

Advanced techniques that account for tangible and intangible factors are essential to refine the accuracy and reliability of business valuations. These small business valuation methods provide a deeper understanding of a business’s worth and adapt to various business structures’ specific complexities and dynamics.

By integrating technology-driven tools and embracing modern valuation methodologies, companies can achieve a more nuanced and forward-looking perspective on their financial health and market position.

Valuation for Different Business Structures

The structure of your business can play a significant role in determining its value, so let’s examine how valuations differ based on your company’s legal and organizational framework.

Sole proprietorships vs. partnerships

The valuation process can vary slightly depending on your business structure. Sole proprietorships are often simpler to value, while partnerships may involve additional complexities like buy-sell agreements.

Corporation and LLC valuation nuances

Corporations and LLCs have distinct legal and tax structures that can impact their valuation. Consider factors like shareholder agreements and potential tax implications.

Franchise valuation considerations

Franchises have unique factors, such as franchise fees, brand value, and territorial rights, that must be accounted for in the valuation process.

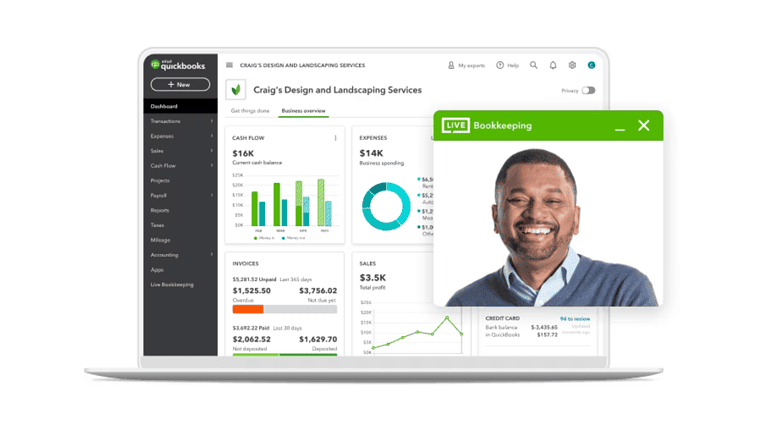

Tech-Driven Valuation Tools and Resources

Many online business valuation calculators can help you estimate your business’s value quickly and easily. These can be a helpful starting point, but remember that they may not capture all the nuances of your specific business.

Artificial intelligence and machine learning are increasingly used in business valuation to analyze large datasets and identify patterns that might not be apparent to human valuators.

Automated tools can offer convenience and speed, but they may need more depth and customization of a professional valuation. Weigh the pros and cons carefully before relying solely on automated tools.

Alternatives to Traditional Business Valuation Methods

While traditional valuation methods offer a solid foundation, they might only sometimes be the best fit for some businesses, particularly startups and early-stage companies. Let’s explore a few alternative approaches that can provide valuable insights into these scenarios.

The Berkus Method for Startup Valuation

The Berkus Method focuses on five key areas: soundness of the idea, prototype existence, quality of the management team, strategic relationships, and existing sales or product traction.

This approach is ideal for startups lacking significant financial history or tangible assets. It allows for a more qualitative assessment of the business’s potential.

Scorecard Valuation Methodology

This method involves comparing your startup to similar companies that have received funding. It helps you benchmark your progress and estimate your value based on market trends.

The Scorecard Method allows you to fine-tune your valuation based on specific metrics like team experience, technology risk, and market size.

First Chicago Method

This method creates three valuation scenarios: best-case, base-case, and worst-case. This helps you understand possible outcomes and make more informed decisions.

By assigning probabilities to each scenario, you can calculate a weighted average valuation that reflects your business’s potential risks and rewards.

Final Thoughts on Small Business Valuation

Valuing your small business isn’t a one-time event; it’s an ongoing process that evolves alongside your company. Regularly revisiting your valuation ensures you’re always aware of your business’s worth and empowers you to make informed decisions.

Remember, a well-informed entrepreneur is a successful entrepreneur. So, take the time to understand the methods, explore the options, and unlock your business’s true value today.