10 Tax Tips for Small Businesses

Tax season can be a significant source of stress for small business owners. The complexity of tax laws and the burden of recordkeeping can be overwhelming.

However, with careful planning and strategic execution, you can simplify the process and maximize your tax savings.

Let’s dive into some powerful strategies backed by both professional advice and the real-life experiences of small business owners like you.

These insights are designed to capture your interest and spark a desire to implement these practices, ultimately guiding you toward taking action that can positively impact your business’s bottom line.

What Are the 10 Tax Tips?

Financial Disclaimer: The information provided in this newsletter is for general informational purposes only. You should consult a professional tax advisor or accountant before making any financial decision based on the information presented.

#1) Understand Basic Tax Laws

It’s essential to be aware of the tax laws in the areas where your business operates. Each country has its own tax system with unique rates and structures.

You should also consider any international tax implications if you do business abroad. This includes VAT (Value-Added Tax), GST (Goods and Services Tax), and corporate income taxes.

#2) Choose the Right Business Structure

Your choice of business structure (like sole proprietorship, partnership, limited liability company, or corporation) affects how you do your taxes. Different countries have different business structures with different tax implications. For example, in the US, sole proprietors report their business income on their personal tax returns, while corporations pay corporate income taxes.

#3) File Income Taxes Accurately

First, determine whether you need to file personal or corporate tax returns. Then, make sure you report all your business income, expenses, and deductions correctly. For example, in the US, you’ll use Form 1040 for personal income tax and Form 1120 for corporate tax.

#4) Manage Payroll and Withholding Taxes

If you employ people, you must follow the rules, withhold payroll taxes, and contribute to social security, pension schemes, or national insurance as per local regulations. My go-to tool for managing and automating payroll is Gusto.

#5) Handle Sales Tax, VAT, or GST

If necessary, add any taxes, like VAT, GST, or other sales taxes, to your receipts and invoices. Stripe has a great Stripe Tax integration that automatically includes sales tax calculations in your receipts and invoicing.

#6) Maximize Your Tax Deductions and Expenses

Are you a business owner looking to lower your tax liability? One great way is to understand what expenses you’re allowed to deduct.

This can include everything from software and office rentals to salaries and business-related travel. For instance, last year, I attended a few conferences and deducted my hotel, flight, and conference fees from my business revenue.

#7) Take Advantage of Retirement Plans

Consider opening a retirement plan for your business. Not only will it help you save for retirement, but it can also help you save on taxes!

Contributions to retirement plans such as a solo 401(k) or SEP IRA are tax-deductible, meaning they can lower your taxable income. Plus, the savings in some of these plans can grow tax-free until you withdraw them during retirement.

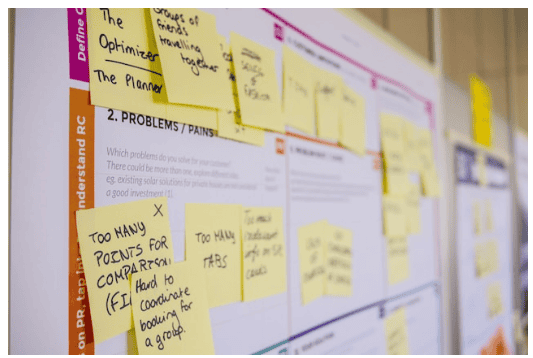

#8) Keep Solid Records

Keeping good records of your finances is essential for managing your money and staying compliant with taxes. Accurately track your income, expenses, and employee payments.

QuickBooks is an excellent tool for managing financial records. It’s user-friendly and makes it easy for your accountant to pull your data at tax time.

#9) Know When the Deadlines Are

Ensure you stay up-to-date on tax deadlines for filing returns and paying taxes owed. Please meet these deadlines to avoid penalties and interest charges. In the US, the deadline for individuals is April 15th, but for businesses, it can vary depending on the type of entity and filing method.

How Do You Prepare for Taxes

Tax season doesn’t have to be a nightmare for small business owners. Preparation and understanding go a long way in streamlining the process and potentially reducing your tax burden. Here are some essential tips to help you navigate tax season with confidence.

Tax Form Checklist

As it’s fresh in your brain, create a tax checklist for next year right now!

Make a checklist of all the accounts, documents, and information you need for this year’s taxes so you don’t have to scramble at the last minute next year. Here is an example of a small business tax checklist:

Small Business Tax Checklist

- Business information, like classification and tax status

- Previous year’s tax return

- Income Statement (P&L) – from Accounting Software (QuickBooks)

- Balance Sheet (Assets) – from Accounting Software (QuickBooks)

- Receipts and invoices for deductible expenses

- Monthly bank statements – from Bank accounts (Mercury)

- Monthly credit card statements – from Business credit cards (Chase)

- Loan statements – from Loan accounts

- Employee wages and payroll records – from Payroll Software (Gusto)

- Estimated tax payments from each quarter

Small Business Tax Deductions

Here are some tax deductions you can qualify for

- Home office expenses – if you use a portion of your home exclusively for business purposes

- Vehicle expenses – if you use your personal vehicle for business purposes

- Business travel expenses – including transportation, lodging, and meals while on business trips

- Supplies and equipment purchases – such as office supplies or new computer equipment

- Advertising and marketing expenses – including website costs, print ads, and social media advertising

- Professional services fees – such as legal or accounting fees related to your business

- Insurance premiums – including health insurance premiums for self-employed individuals

- Retirement contributions – including contributions to a SEP IRA or Solo 401(k)

- Education and training expenses – if they are related to your business or industry

Remember to keep detailed records and receipts for all of your deductions in case of an audit. It’s also essential to consult with a tax professional or use tax software to ensure you take advantage of any federal income tax deduction you qualify for.

Remember that every deduction adds up and can help reduce your taxable income, potentially saving you hundreds or even thousands of dollars on your taxes. So be sure to do your research and take advantage of all deductions available to you.

QuickBooks: Manage Your Business Expenses and Bookkeeping

QuickBooks is a valuable accounting software solution designed to streamline financial management for small businesses.

It simplifies tasks like tracking income, categorizing expenses, generating reports, and facilitating tax preparation. To further enhance the benefits of QuickBooks, consider the following strategies:

- Integrate with complementary tools: QuickBooks offers seamless integration with various third-party apps and services. Connect your bank accounts, point-of-sale systems, and other business tools to automate data flow and minimize manual data entry.

- Explore industry-specific add-ons: Numerous third-party add-ons are available to extend QuickBooks’s functionality, tailoring it to your industry’s specific requirements. These add-ons can optimize inventory management, job costing, and project tracking processes.

- Consult a QuickBooks ProAdvisor: If you require additional support or want to maximize the software’s capabilities, a certified QuickBooks ProAdvisor can offer customized training, setup assistance, and ongoing optimization aligned with your business needs.

Gusto: Manage Your Payroll

Gusto is a powerful platform for streamlining your payroll processes. It automates tax calculations, filings, and payments, saving you time and minimizing the risk of errors. Here’s how to get even more out of Gusto:

- Utilize time tracking integrations: Gusto integrates with popular time tracking software. Syncing timesheets with Gusto ensures accurate payroll calculations and reduces administrative tasks.

- Leverage Gusto’s benefits administration: If you offer employee benefits, Gusto provides convenient administration tools to manage health insurance, retirement plans, and other offerings directly within the platform.

- Explore Gusto’s HR resources: Gusto offers helpful HR resources, including guides, templates, and expert advice. Use these resources to stay informed about labor laws, best practices, and compliance matters.

What Are Taxes?

Taxes are the lifeblood of a functioning society. They represent mandatory contributions the government collects to fund essential public services like infrastructure, education, healthcare, and defense. As a small business owner, you play a vital role in contributing to these shared resources.

While taxes are a necessity, it’s equally important to understand your rights as a taxpayer. The tax code offers numerous deductions and credits designed to support small businesses. Staying informed about these provisions can help minimize your tax burden while maintaining compliance.

Remember, tax laws evolve. Regularly seek resources and updates from sources like the IRS website or a tax professional to ensure you keep up with the latest changes affecting your business.

How Can A Tax Professional Benefit You

As a small business owner, you may think you are saving money by filing through TurboTax or another tool. But the truth is…

Taxes are complicated, especially for small business owners. And I’m sure you are leaving money on the table by doing it yourself.

To be honest, I pay about $300 for my accountant, which is more than spending around $130 for TurboTax. But what do you get in return?

- Expert Advice: Tax laws are constantly changing, and keeping up with all the updates can be challenging. Accountants stay current with these changes, ensure your taxes are filed accurately, and provide valuable advice.

- Time Savings: As a business owner, your time is valuable. By outsourcing your tax preparation, you can focus on what you do best – running your business.

- Accuracy: Your accountant checks your accounting data to ensure accuracy and identify any potential errors or discrepancies. This can save you from costly mistakes and audits in the future.

- Reduced Stress: Tax preparation is stressful and time-consuming. By hiring an accountant, you can chill out and know your taxes are taken care of by a professional.

- Year-Round Support: An accountant is more than just someone you work with once a year during tax season. They can provide year-round support and advice for all financial matters related to your business.

- Audit Help: Having an accountant by your side can provide peace of mind in the event of an audit. They can handle any correspondence or inquiries from the IRS or other agencies on your behalf.

The best part is that for about $300, my accountant has saved me thousands of dollars in taxes by maximizing expenses, depreciating assets, finding qualifying credits, and avoiding costly mistakes. This means more money in my pocket to invest back into my business.

Final Thoughts on Taxes For Small Business Owners

Tax season can present challenges, but it needn’t be a source of undue stress. By implementing these essential tips, from diligent recordkeeping to exploring software solutions, you streamline the process and potentially optimize your tax outcomes. Proactive organization throughout the year is crucial for a smooth tax season!

While tax preparation can be complex, this guide aims to equip you with the knowledge and strategies to confidently approach your small business taxes. Consider consulting a qualified tax professional if you require further support or tailored advice.

FAQs About Taxes

What are deductible expenses for small businesses?

Deductible expenses for small businesses include costs that are both ordinary and necessary for operating the business. These include rent, utilities, office supplies, and advertising expenses. Tracking these expenses accurately throughout the year can significantly reduce your taxable income.

How often should small businesses file taxes?

Small businesses should file income taxes annually, but you must pay estimated taxes quarterly if you expect to owe at least $1,000 in federal tax for the year. Staying on top of these quarterly payments helps avoid penalties and interest for underpayment.

Can I claim home office expenses on my taxes?

Yes, you can claim home office expenses if you use a portion of your home exclusively for business purposes. To qualify, the space must be your primary place of business and used regularly for operations. There are two methods for calculating the deduction: the simplified option and the regular method.

What is the difference between an employee and an independent contractor for tax purposes?

For tax purposes, an employee is someone whose work you control, not just in terms of the final product but also how it is done. An Independent contractor, on the other hand, operates under their own guidance and has more control over how they complete their work. This distinction affects how you withhold and pay taxes, including Social Security and Medicare.

Are there any tax credits available for small businesses?

Several tax credits are available for small businesses, including the Small Business Health Care Tax Credit for providing health insurance to employees and the Work Opportunity Tax Credit for hiring from certain groups facing employment barriers. These credits can directly reduce the amount of tax you owe.

What records should I keep for tax purposes?

You should keep detailed records of all income and expenses, receipts, and documentation related to your business operations. These records are essential for preparing your tax returns and supporting items reported on your returns in case of an audit.

How can I make tax filing easier for my small business?

To make tax filing easier, consider using accounting software to track income and expenses throughout the year. Hiring a professional accountant can also help ensure accurate tax returns and take advantage of all available deductions and credits.

What should I do if I can’t pay my taxes on time?

If you can’t pay your taxes on time, filing your return is essential to avoid penalties for late filing. The IRS offers payment plans that allow you to pay your tax bill over time. Contacting the IRS to discuss your options as soon as possible can help manage the situation more effectively.